Kurt Osterberg

Browsing All Posts By Kurt Osterberg

-

Finance 0

Meta Reports An Excellent Quarter – And The Stock Is -12%

Facebook (META) just reported an excellent 1Q24 – but the stock is off 12% in the after hours. Revenue was +27% and EPS +114% to $4.71 compared to the year ago quarter. Operating margin of 37.9% c...On April 25, 2024 / By Kurt Osterberg -

Finance 0

Caterpillar Inc. Reports EPS Beat In Q1, Misses Slightly On Revenue

Image Source: Unsplash Caterpillar Inc. (NYSE: CAT), a leading manufacturer of construction and mining equipment, announced its first-quarter results for 2024. The results revealed a mixed perfor...On April 25, 2024 / By Kurt Osterberg -

Finance 0

Meta Commentary – Thursday, April 25

Image Source: Unsplash Meta Crashes 12%Shares in iconic US tech company Meta (parent of Facebook) are trading heavily lower ahead of the US open today. The stock is currently almost 13% down from y...On April 25, 2024 / By Kurt Osterberg -

Finance 0

The Jones Act: Consequences Of A Destructive Industrial Policy

Image Source: Pexels The United States has had an industrial policy aimed at boosting its domestic shipbuilding industry since the passage of the Merchant Marine Act of 1920, commonly known as the ...On April 25, 2024 / By Kurt Osterberg -

Finance 0

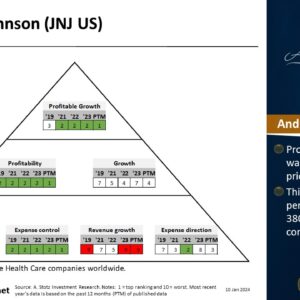

US Stock: Johnson & Johnson

Company: Johnson & JohnsonBloomberg ticker: JNJ USMarket cap: US$383,813mBackground: Johnson & Johnson, through its subsidiaries, is engaged in the research and development, manufacture, a...On April 25, 2024 / By Kurt Osterberg -

Finance 0

German Consumers Take An Optimistic Turn

Image source: Pixabay A better-than-expected improvement in consumer confidence not only adds to recent positive macro news out of Germany but also gives hope that private consumption could pick up...On April 25, 2024 / By Kurt Osterberg -

Finance 0

Japanese Yen Hits All-Time Low As BoJ Meeting Commences

Image Source: Pixabay The USD/JPY pair reached an all-time high on Thursday, touching the 155.50 level. This development comes as the Bank of Japan (BoJ) starts its two-day monetary policy meeting ...On April 25, 2024 / By Kurt Osterberg -

Finance 0

The Government Spent $11 Trillion

Image Source: Pexels Uncle Sam tried his best to buy a recovery. The sheer amount of money redistributed by the federal govt the past four years is incomprehensible. Here’s the thing: the tra...On April 25, 2024 / By Kurt Osterberg -

Finance 0

Thoughts For Thursday: Stock Indices Stay Steady Amid Corrections

So far April has been a month for corrections but the major indices have kept a steady keel from Tuesday to Wednesday, this week. Middle East tensions are keeping oil prices high which is spilling ove...On April 25, 2024 / By Kurt Osterberg -

Finance 0

Two Trades To Watch: EUR/USD, FTSE Forecast

Image Source: Pixabay EUR/USD rises after German consumer confidence & ahead of US GDP data German consumer confidence rose to 24. US Q1 GDP is expected to slow to 2.5% from 3.4% EUR/USD tests ...On April 25, 2024 / By Kurt Osterberg

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 4514

- Next Page »

Top Posts

-

The Importance for Individuals to Use Sustainable Chemicals

The Importance for Individuals to Use Sustainable Chemicals

-

Small Businesses: Finding the Right Candidate for the Job

Small Businesses: Finding the Right Candidate for the Job

-

How to Write the Perfect Thank You Letter After Your Job Interview

How to Write the Perfect Thank You Letter After Your Job Interview

-

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

-

China suspected in massive breach of federal personnel data

China suspected in massive breach of federal personnel data

New Posts

2024 Q1 GDP Underperforms Expectations At 1.6 Percent Vs 2.3 Percent Expected

American Airlines Swings To A Loss, But Tops Estimates For Q2 Forecast

Analytical Overview Of The Main Currency Pairs – Thursday, April 25

US GDP Growth Slows Markedly, And Inflation Remains The Focus

Airline Industry Expected To Soar With Record Summer Travel