We are now fast approaching a critical earnings season. Given the recent trade war volatility, investors are looking forward to a bullish earnings season to lift the markets. Luckily, hopes are high that companies are on track for a stellar earnings season with fundamentals remaining relatively strong. Indeed, earnings for companies in the S&P 500 are expected to grow 17.3% in the first quarter, with sales up 10%. These rates represent the fastest pace of growth since the first quarter of 2011.

With this in mind, we used TipRanks’ Earnings Calendar to see which hot stocks are due to report their earnings in the next couple of weeks. Crucially, the Earnings Calendar also displays the analyst consensus and average price target of each stock, so you can immediately assess the Street’s outlook on the stock going into the print.

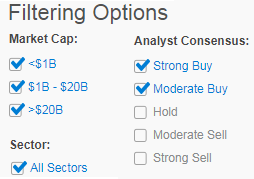

Here we searched for only stocks that have a ‘Strong Buy’ and ‘Moderate Buy’ analyst consensus rating. From the generated results, we scanned for stocks with notable upside from current prices.

Now let’s delve deeper into these five top stocks:

1. Zions Bancorp (ZION)

Vining Sparks’ Marty Mosby is one of the Top 10 analysts on TipRanks for his stock picking ability. And in his first-quarter earnings preview, Mosby upgraded Zions bank from ‘Buy’ to ‘Strong Buy.’ This rating comes with a $65 price target (24% upside potential).

“We believe that ZION should be able to generate stronger revenue per share growth than the market currently anticipates, as it should benefit from both rising interest rates and their respective strategic initiatives” cheers Mosby. He is bullish on Large Cap US banks in general- and spies multiple tailwinds for the sector from the recent tax reform and rate hikes to stable credit costs.

2. T-Mobile US (TMUS)

T-Mobile US, Inc. is the third-largest wireless carrier in the US. The company is easily outpacing competitors down to: 1) a greatly improved network, and 2) targeted marketing for under-served urban and rural areas. In 2017, for example, TMUS opened 1,500 T-Mobile-branded stores and 1,300 MetroPCS-branded stores.

No Comments