AT40 = 37.6% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 40.2% of stocks are trading above their respective 200DMAs

VIX = 21.5

Short-term Trading Call: neutral

Commentary

via GIPHY

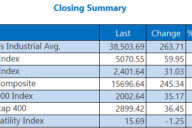

The week ended badly with a 2.2% drop in the S&P 500 (SPY). The week began with the exact same loss. Between the bookends market participants breathed collective sighs of relief and hope with three up days. Each day this week except one, the S&P 500 touched critical uptrending support at its 200-day moving average (DMA). This test of bear/bull wills at support has created spectacular market reversals as various catalysts have postured, posed, and postured again. It feels like the “barbarians” of sentiment are running amok with an ultimate resolution still uncertain. I am frankly quite surprised the market managed to stay out of oversold territory this week.

For 10 days the S&P 500 has hovered just above its 200DMA support – breaking 4 times, closing below once, and perfectly tapping another time. Is support strengthening or weakening?

Alongside the churn, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, flashed encouraging signs. While the S&P 500 has been unable to break free of its 200DMA’s gravitational pull, AT40 ended the week well off recent lows. AT40’s closing high of this week even stopped just short of March’s high. This almost subtle divergence from the languishing of the S&P 500 suggests that fewer and fewer stocks, albeit big and important ones, are participating in the market’s pains. The barbarians banging away at support are smashing fewer and fewer stocks…ever so subtly.

AT40 (T2108) continues to drift higher and away from oversold conditions.

The currency markets have also demonstrated a relative lack of alarm. My favorite indicator of sentiment is the Australian dollar (FXA) versus the Japanese yen (JPY). AUD/JPY hit a low two weeks ago and has chopped higher ever since with more up days than down days. I am astounded the Australian dollar has avoided a massive beating with all the implications of a trade war for its biggest trading partner: China.

Source: TradingView.com

While AUD/JPY remains in a sell-off mode defined by a steeply declining 50DMA, recent stock market sell-offs and heating rhetoric on a US-China trade war did not prevent this tell-tale currency pair from generally rallying off March lows.

No Comments