This is a first: The European Central Bank (ECB) has asked Deutsche Bank to calculate the impact of selling one of its trading positions as it is considering withdrawing from the investment bank. It wants to know if Germany’s largest bank can come out of this activity without guarantees from the State or German taxpayers’ money. In particular, the risks associated with the unwinding of derivatives are the most worrisome of all – we wrote about that as early as 2013: Deutsche Bank has the most exposure to derivatives in the world, to the tune of $64 Trillion, or 16 times Germany’s GDP…

But isn’t it already too late? La Tribune quotes a renowned analyst, Stuart Graham, from Autonomous Research, who estimates that the German bank is probably “beyond repair”. According to Süddeutsche Zeitung, “Deutsche Bank is one of the most dangerous financial institutions in the world, due to its complex activities.”

The Frankfurt-based bank is also piling up litigation and trials. Since 2012 it has spent more than €20 billion in legal expenses, which is much more than the capital brought in by investors during the same period… In January 2017, the bank had to pay a $7.2 billion fine to the American authorities to settle the sub-primes crisis. Along with convictions for manipulating the LIBOR rate and precious metals, the German bank is everywhere there is something fishy going on.

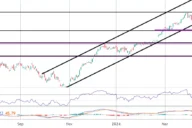

All this bad news led Standard & Poor’s, on April 13, to place their long-term note at A-, under “surveillance with negative implications”. The stock price shows massive defiance by investors: at around €11, it is merely above what it was in September 2016, when the spectre of Lehman Brothers was hovering above the financial institution. Already in 2015, the bank had failed the Fed’s stress tests… Decidedly, Deutsche Bank is having trouble getting out of the crisis.

No Comments