The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a matter of days. The market recovered most of those losses by early March but volatility has returned with a vengeance over the last few weeks. The culprit this time is supposedly tariffs as the Trump administration called everyone’s bluff and did what everyone hoped they wouldn’t.

The truth is that we rarely know why markets move the way they do. We can’t possibly know the motivations of all the sellers and buyers in a market. All we can do is observe the result. If sellers are feeling more urgency to sell than buyers are to buy, then the price will go down until that sense of urgency is balanced once again. And vice versa. When I was much younger and new to this business I once asked an old trader why the market was down one day and his answer was a simple, “more sellers than buyers”. While not technically correct that simple statement tells you all you need to know.

I wouldn’t say that the motivations of buyers and sellers is irrelevant but it is a lot less important than most everyone thinks. It is the actions of investors and traders that shape the economy not the other way around. When owners of junk bonds start to get worried about the issuers and become sellers, the result is higher interest rates for marginal borrowers or in extreme cases a complete lack of funding. Those higher rates and reduced funding at the margin have an impact on the economy. Do defaults drive junk bond prices or do junk bond prices drive defaults? Probably a little of both I think.

I try to imagine that I have no access to the news, that my only source of information about the economy comes from the regular release of economic data and the market reaction to those reports. When I do that today, I come to a pretty clear conclusion – the global economy is losing momentum. This is evident in the economic reports which have been almost uniformly weaker than expected recently – here and in Europe – and also in the markets where both short term and long term interest rates have fallen recently. It isn’t a large change – yet – but it is pretty obvious. Why the economy is decelerating is much less important than the fact that it is.

As for stock market volatility, I will offer an additional explanation, one much simpler than unexpectedly hot wage numbers, short volatility trades and impending tariffs. My explanation is quite simple – the Fed is tightening policy, raising interest rates and reducing the size of its balance sheet. If you believe that QE had an impact on the markets – and I am hard pressed to find anyone who doesn’t – then you have to believe that its reversal will as well. Volatility is nothing more than the inverse of liquidity. With the Fed reducing the latter one should expect more of the former.

Economic Reports

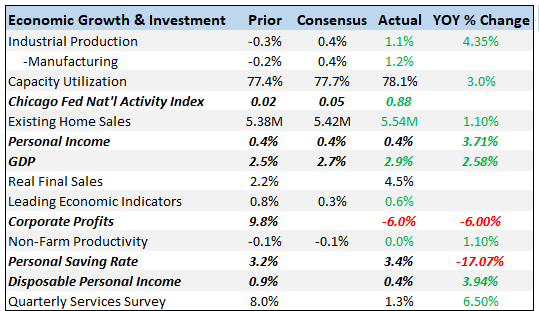

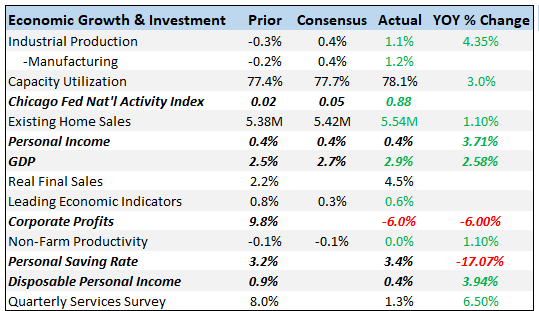

Economic Growth & Investment

The Chicago Fed National Activity Index, one of those broad-based indicators we keep a close eye on, jumped to 0.88, much better than expected. But keep in mind that the last two months have been revised lower by a significant amount so we might view this one with just a bit of skepticism. But even if it is revised lower next month, the message is pretty clear. Even if we are slowing a little, with a three month average of 0.37, we aren’t even close to recession.

No Comments