While the outlook for the Canadian dollar looked dire just a few months ago, the currency appears to have recently turned a corner. After looking oversold in late March, the currency managed to strengthen thanks to a rebound in crude oil prices. Two weeks later, the Canadian dollar received more good news as the Trump administration pushed to conclude NAFTA talks at a faster pace. In more recent times, the currency is strengthening once again as traders anticipate more rate hikes. Following the Canadian dollar’s rebound, we have upgraded our medium-term outlook on the currency to neutral accordingly. While the loonie’s comeback has been impressive, the longer-term outlook for the Canadian dollar remains neutral.

Bank of Canada tends to chase trends in growth and inflation

Looking at the BoC’s rate hikes last year, the institution was behind the curve in tightening monetary policy. Similar to other central banks, the Bank of Canada tends to chase growth and inflation once the trend has become fairly clear.

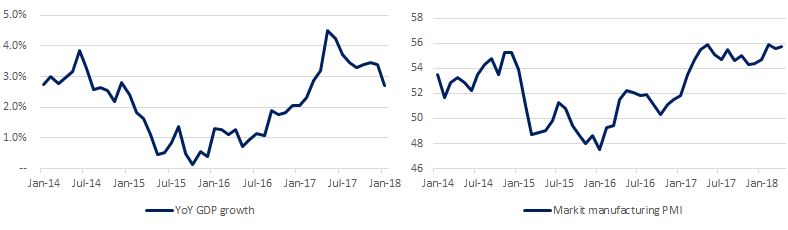

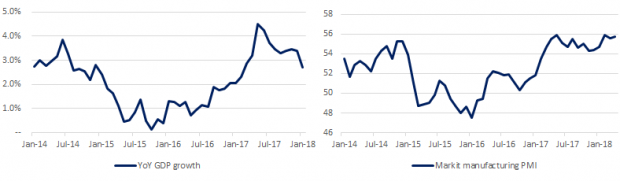

Looking more closely at the data, year-over-year Canadian GDP growth peaked last May (4.5%) and has been decelerating since that time. The impact from the Liberal government’s stimulus program (passed in 2016), came to fruition in 2017 as the government executed its incremental spending plans. Year-over-year growth was also high thanks to weak comparable figures in early 2016 (when growth was just 0.7% – 1.3%). This is shown below:

Both actual growth and future expectations appear to have peaked

Source: StatsCan, Markit, MarketsNow

While Governor Poloz provided neutral policy guidance in the first half of the year, the Bank of Canada shocked markets by raising rates in July 2017 (after growth had peaked). Since that time, the Bank has raised rates in September 2017 and again in January 2018, bringing the overnight rate to 1.25%.

Looking at the Canadian dollar, the currency has strengthened around recent Bank of Canada interest rate decisions. Unsurprisingly, speculators are keen to bet on the Canadian dollar when the country’s central bank is “normalizing” interest rates.

No Comments