Following futures positions of non-commercials are as of April 10, 2018.

10-year note:

Currently net short 330.6k, down 44.7k.

Annual core CPI rose stronger-than-expected 2.12 percent in March.This was the first year-over-year reading with a two handle in a year.

Nonetheless, core PCE – the Fed’s favorite measure of consumer inflation – is not as strong.The last time this metric rose at two percent or higher was in April 2012.Even here, it has been trending higher, with February up 1.6 percent y/y, up from 1.3 percent last August.

On Wednesday when the CPI data was published, gold rallied 1.1 percent, but 10-year Treasury yields fell a basis point to 2.79 percent.The bond market is yet to sniff inflation in earnest.The 10-year rate (2.83 percent) still has not found a way to break out of a three-decade-old descending channel it is in, although it came close a few times in recent past.

Inflation expectations – represented by the five-year, five-year forward inflation expectation rate – have been trending higher since July 2016, with two-plus readings since last December, but nothing crazy. As of Thursday, it stood at 2.21 percent.

The point is, it is too soon to conclude there has been a material shift in inflation expectations or inflation itself.Economists cite base effect for the recent upward trend in inflation.If so, it is cyclical in nature, not structural. Hence bond vigilantes’ indifferent attitude toward it.

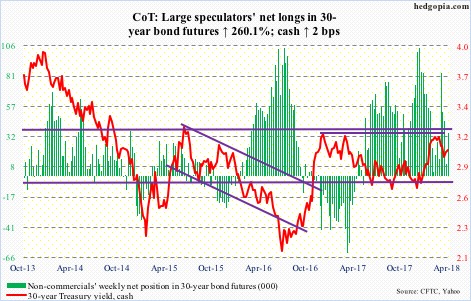

30-year bond

:

Currently net long 34.9k, up 25.2k.

Major economic releases next week are as follows.

Retail sales (March), the NAHB housing market index (April) and Treasury International Capital data (February) are due out Monday.

Retail sales inched down 0.07 percent month-over-month in February to a seasonally adjusted annual rate of $492 billion. Year-over-year, sales rose four percent.

Homebuilder sentiment fell a point m/m in March to 70.Last December’s 74 was the highest since July 1999.

Foreigners have been loading up on US stocks.In the 12 months through January, they purchased $140 billion worth.

Housing starts and industrial production – both for March – come out Tuesday.

Housing starts declined seven percent m/m in February to 1.23 million units (SAAR).January’s 1.33 million was the highest since August 2007.

No Comments