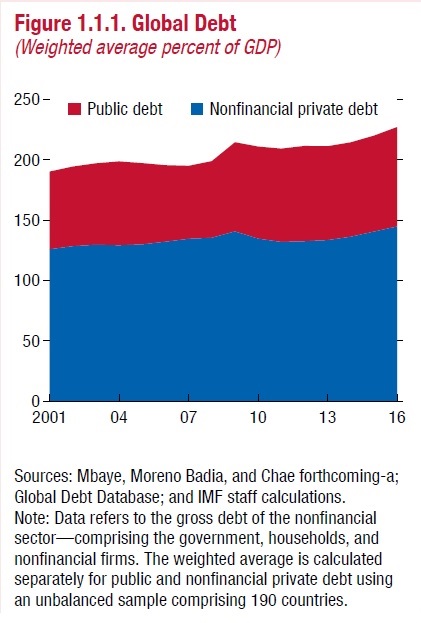

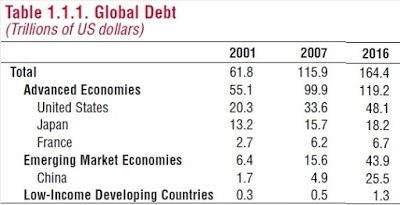

“At $164 trillion—equivalent to 225 percent of global GDP—global debt continues to hit new record highs almost a decade after the collapse of Lehman Brothers. Compared with the previous peak in 2009, the world is now 12 percent of GDP deeper in debt, reflecting a pickup in both public and nonfinancial private sector debt after a short hiatus (Figure 1.1.1). All income groups have experienced increases in total debt but, by far, emerging market economies are in the lead. Only three countries (China, Japan, United States) account for more than half of global debt (Table 1.1.1)—significantly greater than their share of global output.”

Thus notes the IMF in the April 2018 issue of Fiscal Monitor

(Chapter 1: “Saving for a Rainy Day,” Box 1.1, as usual, citations omitted from the quotation above for readability). Here’s the figure and the table mentioned in the quotation.

The figure shows public debt in blue and private debt in red. In some ways, the recent increase doesn’t stand out dramatically on the figure. But remember that the vertical axis is being measured as a percentage of the world GDP of about $87 trillion, so the rising percentage represents a considerable sum.

Here’s an edited version of the table, where I cut a column for 2015. The underlying source is the same as the figure above. As noted above, the US, Japan, and China together account for half oftotal global debt.

The rise in debt in China is clearly playing a substantial role here. Explicit central government debt in China is not especially high. But corporate debt in China has risen quickly: as the IMF notes of the period since 2009, “China alone explains almost three-quarters of the increase in global private debt.”

In addition, China faces a surge of off-budget borrowing from financing vehicles used by local governments, which often feel themselves under pressure to boost their local economic growth. The IMF explains:

No Comments