Gold is hammering on crucial resistance. This has been going on for a while now. A breakout will happen – sooner or later.

Kudos to the gold bugs, they are at it again.

Once again, they are hammering on resistance that has been in place since July 2016 (Chart 1). The latest salvo came after they defended $1,300/ounce three weeks ago. This support goes back to September 2010. Resistance lies at $1,360-70.

Wednesday, gold rallied 1.1 percent to $1,360. In fact, intraday it rose as high as $1,369.40, before backing off, leaving behind a little bit of a tail. It is also right at the daily upper Bollinger band.

The 50-day ($1,331.68) lies underneath.

Gold benefited from some fundamental tailwinds this week. President Trump’s Wednesday warning to Russia that it should get ready for a missile strike on Syria probably contributed to a risk-off feeling among market participants. There were also media reports that he discussed firing Deputy Attorney General Rod Rosenstein.

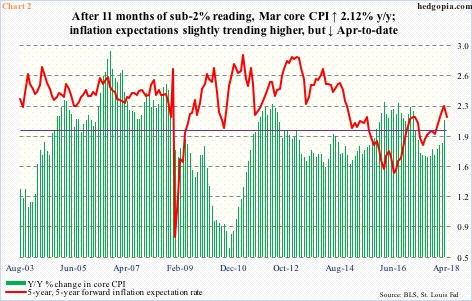

Also Wednesday, the consumer price index for March was released. Prices rose more than expected. Core CPI in the 12 months to March increased 2.12 percent (Chart 2). This was the first reading with a two handle in a year. (That said, core PCE – the Fed’s favorite measure of consumer inflation – has not crossed that threshold since May 2012. In February, it rose 1.6 percent.)

Inflation expectations – represented by the five-year, five-year forward inflation expectation rate – have been trending higher since July 2016, with two-plus readings since last December. Even here, April-to-date is down.

It is too soon to conclude there has been a material shift in inflation expectations or inflation itself. Time will tell if the current uptick in inflation is cyclical or structural in nature. As things stand, the yellow metal might need help from other sources. And they are present.

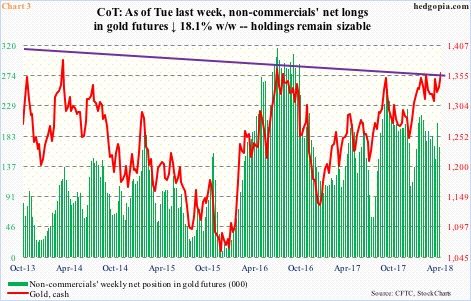

Non-commercials are hanging in there.

No Comments