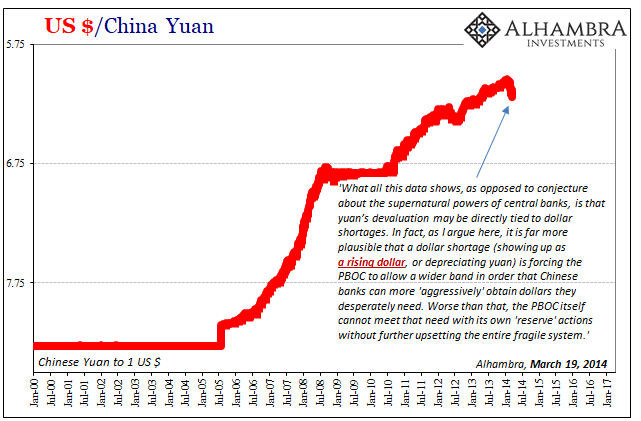

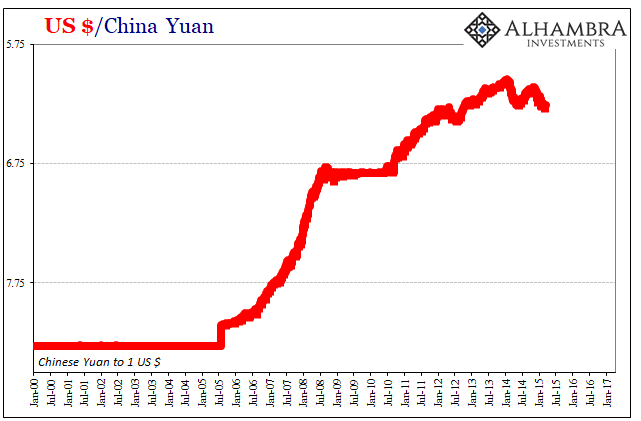

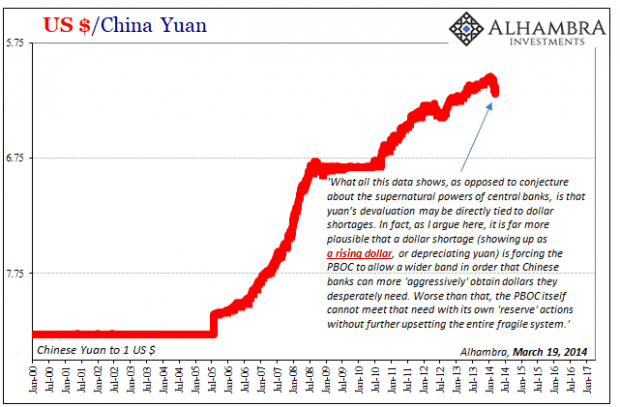

Very early on in the turn, I mean very early, you could already tell there were substantial problems underneath. By the time CNY started lower, against all expectations, there had already been serious signs of trouble in China for months by then. In that initial seemingly minor drop in early 2014, the PBOC’s actions belied a stable system. If you knew what to look for, you could see a central bank struggling very hard to maintain order rather than the capable and accomplished technocratic institution as it was always described (and somehow still is).

Chinese officials would go through several additional programs throughout the rest of 2014 (I won’t list them here) to try to rescue first their monetary paradigm and second their economy thereafter. Obviously, this flew directly in the face of conventional wisdom which holds that the amount of “reserves” on hand act as insurance against just this sort of thing. The larger the pile of them, as China held the largest in the world, then the more of a guarantee.

Yeah, no.

It’s a difficult concept to grasp because the way that convention is written seems perfectly logical and intuitive. But that’s not how these things go. The more “reserves” you have it instead suggests just how much of a potentially massive problem you could run into beyond your grasp, not an unassailable solution.

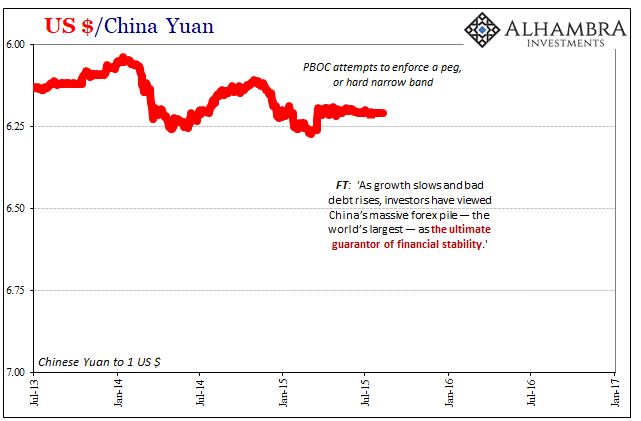

About a year after I wrote that initial assessment, by March 2015 CNY hadn’t really progressed all that much farther downward. It didn’t at least on that basis appear as if things could get so far out of hand. Still, there were only growing signs of the same big negatives. In what sure seems in hindsight a last-ditch effort, from that point forward for a length of almost 5 months the PBOC enforced a shadow peg or at least a narrowed band on the currency.

To do so meant it was the central bank (or others acting on its behalf in official capacities) supplying “dollars” into the marketplace where Chinese banks were having so much trouble obtaining them. Despite having the largest holdings of forex assets, predominantly “dollar” denominated, the world has ever known, and may ever know for that matter, the PBOC was broken anyway.

No Comments