Institutional Shareholder Services (ISS), the largest proxy advisory firm in the U.S., acquired research firm EVA Dimensions last month to improve the quality of the fundamental research it gives to its clients. ISS, which advises shareholders on proxy votes surrounding corporate governance and executive compensation, may begin implementing EVA Dimensions’ models into its recommendations as soon as next year.

This acquisition signals an increase in institutional investor demand for more fundamental research and the diligence it implies. Sophisticated investors want metrics that go deeper than reported earnings so they can get a truer picture of cash flows and hold companies accountable for capital allocation. To achieve improved levels of diligence, research and advisory firms must leverage technology to diligently analyze all available financial data.

What is EVA?

EVA Dimensions focuses its services on economic value added (EVA) or economic earnings. Its CEO, Bennett Stewart, co-founded the firm Stern Stewart that first pioneered the widespread application of economic earnings in corporate finance in the ‘80s and ‘90s. More details on this history are in “If ROIC Is So Great, Then Why Doesn’t Everyone Use It?”

The acquisition of EVA Dimensions continues ISS’ trend toward more diligence on fundamentals, i.e. economic earnings and return on invested capital (ROIC), and away from focusing almost purely on Total Shareholder Return (TSR). After facing criticism for promoting short-termism on corporate boards, ISS began including ROIC in its analysis last year.

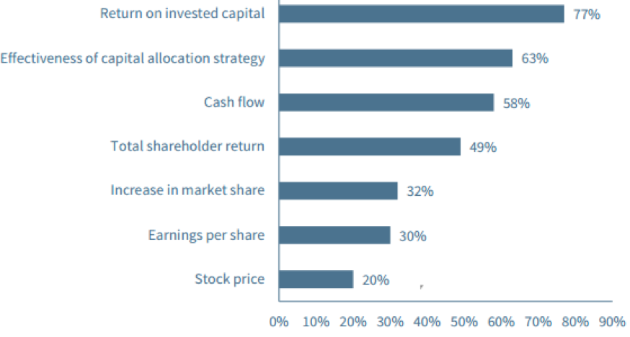

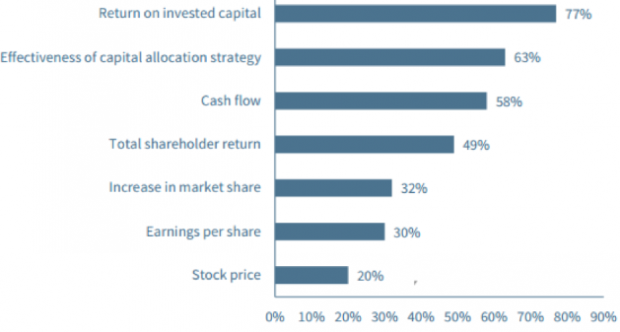

Figure 1 shows why ISS has moved towards greater fundamental diligence. A 2016 survey by Rivel Research found that 77% of buy-side investors chose ROIC as the best performance metric for determining management pay. Only 49% approved of TSR.

Figure 1: 77% of Buy-Side Investors Believe ROIC is an Excellent Metric for Corporate Performance

Sources: David Larcker, Brian Tayan, and Rivel Research

In recent years, activist investors have pushed companies such as General Motors (GM) to adopt ROIC as part of their executive compensation plans. ISS is following the market’s lead.

No Comments