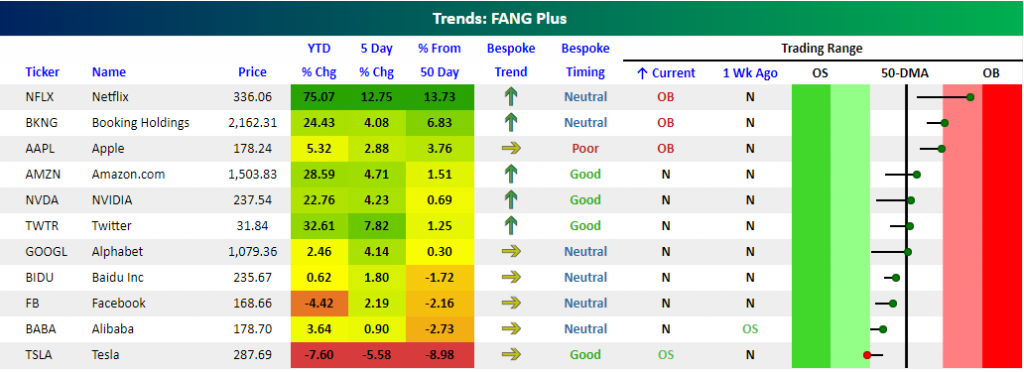

With a gain of over 9% on Tuesday after its strong earnings report on Monday afternoon, shares of Netflix (NFLX) are up an almost ridiculous 75% YTD, 13% in just the last week, and now over 13% above the 50-DMA. The rally for NFLX has been so huge that its market cap is now just $8 billion below Disney (DIS).

With its big gain on Tuesday, NFLX is currently the most overbought of the stocks in the group, but along with Booking (BKNG) and Apple (AAPL), it is one of just three stocks in the group trading at overbought levels right now. The majority of the stocks in the group are currently trading in neutral territory and basically within +/-2% of their 50-DMAs. The only oversold stock in the group is Tesla (TSLA), and it is also the only one that is down over the last week. In terms of timing, though, TSLA actually has a Good rating along with Amazon.com (AMZN), NVIDIA (NVDA), and Twitter (TWTR).

The table below shows how the stocks that make up the FANG+ index have historically performed in the period from the close on 4/17 through the remainder of April. For each stock, we list its median percent change, the percentage of time the stock has traded higher, how frequently it outperforms the S&P 500, and then how it performed during this period in each individual year.

While TSLA is the FANG+ stock that has been the weakest performer lately, the tide may be ready to turn for the stock as the second half of April has actually been a good time of year with a median gain of 4.93% and positive returns 86% of the time. Along with TSLA, shares of Facebook (FB), AMZN, and BKNG have all seen median gains of over 4%. Just four of the FANG+ stocks have seen median returns that are negative, and of those, NFLX and Twitter (TWTR) are the only ones where the median decline is more than 1%.

TWTR has been an especially weak performer during this period since it has been public, but we would note that the sample size is relatively small at just four years. Finally, 2017 was an especially good year for the FANG+ stocks as all eleven of them posted gains during the back half of April, with ten of them exceeding the 1.5% gain of the S&P 500.

No Comments