Novartis AG (NVS – Free Report) reported encouraging results for first-quarter 2018 wherein both earnings and revenues beat estimates driven by strong performance of Cosentyx and Entresto.

First-quarter 2018 core earnings of $1.28 per share beat the Zacks Consensus Estimate of $1.25 and were up from $1.13 recorded in the year-ago quarter.

Novartis AG Price, Consensus and EPS Surprise

Novartis AG Price, Consensus and EPS Surprise | Novartis AG Quote

Revenues increased 10% to $12.7 billion as volume growth driven by Cosentyx and Entresto was partially offset by the negative impact of generic competition and pricing. Revenues also beat the Zacks Consensus Estimate of $12.3 billion.

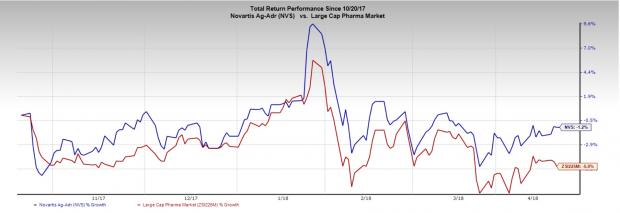

Novartis’ stock has lost 1.2% in the last six months compared with the industry’s 5.0% decline.

All growth rates mentioned below are on a year-over-year basis and at constant exchange rates.

Quarter in Detail

Novartis operates under three segments: Innovative Medicines (Pharmaceuticals), Alcon (Ophthalmology unit) and Sandoz (Generics).

The Innovative Medicines division recorded sales of $8.4 billion, up 6% driven by volume growth of Cosentyx and Entresto. Generic competition impacted sales at the segment, primarily due to the entry of generics for Gleevec in the United States and Europe and ophthalmology. Pricing too impacted sales.

Psoriasis Cosentyx continues to gain traction. Cosentyx sales increased to $580 million, up 35% driven strong growth in all indications and expanded access. Entresto’s sales increased 126% to $200 million driven by increased uptake.

Oncology franchise (excluding Gleevec) grew 6% driven by Promacta/Revolade, Tafinlar + Mekinist, Jakavi and recent launches

Sales at the Sandoz division were $2.5 billion, down 4% due to price erosion in the Unites States. Sales in the United States declined 18% due to competitive pressure. Biopharmaceuticals sales grew 13% mainly driven by launches of Rixathon, the biosimilar version of Rituxan (rituximab) and Erelzi, the biosimilar of Enbrel in EU.

No Comments