When most investors and traders purchase stock it is because they intend to profit from the rise in its price. They are familiar with the mantra: ‘buy low and sell high!’ But there are several other ways of profiting from the ownership of stock shares without having to part with them. In this article, we will examine dividends as an additional method of making money from stock ownership.

When a publicly traded company reports their quarterly earnings from operation, they will often decide to share some of the profits with the owners of the company. This is called a dividend. Whoever owns shares of the company is considered a partial owner of the company. In effect, a dividend is a way of receiving your share of the company’s profits.

Many investors look to dividends as a way of receiving a regular income from an investment portfolio. However, things in the business world can change drastically and knowing how to pick the right stocks to create that regular, dependable cash flow is very important.

One critical thing to remember is that if a company is paying a portion of its profits to shareholders, it may reduce the amount of money available for growing the business itself. Most dividend investors are focused on value rather than profiting from the rapid appreciation of the stock price. Remember, the money they pay you cannot be invested by them in operations.

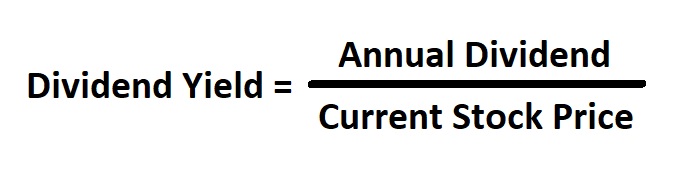

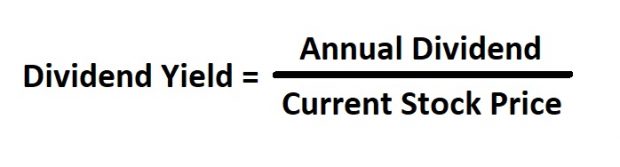

So as a dividend value seeker, we should learn about a ratio called dividend yield. The dividend yield is a simple calculation and many financial websites provide this information freely. The dividend yield tells you how much cash flow you will be receiving for your investment in the shares. It is simply the dividend amount divided by the share price.

As an example, The Walt Disney Company (DIS), pays an annual dividend of $1.68. The previous close, as of this writing, was $99.42 per share. So, the dividend yield is 1.69% ((1.68/99.42) x 100 = 1.689). In the picture below, Yahoo Finance shows a slightly different yield number.

No Comments