After missing earnings estimates five straight times, Philip Morris International Inc. (PM – Free Report) delivered a beat in first-quarter 2018. Moreover, top and bottom lines grew year over year and management also raised its bottom-line view for 2018, courtesy of the tax reforms. However, these factors were not enough to placate investors, who were let down by the fifth consecutive sales miss and drop in constant currency (cc) earnings. This could be largely accountable to soft volumes.

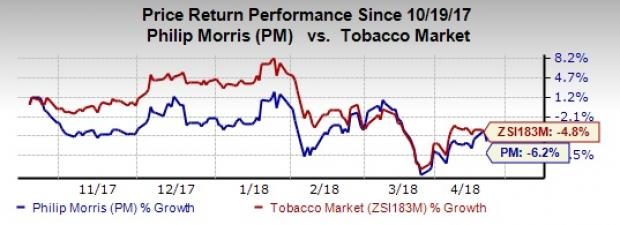

Evidently, shares of the Zacks Rank #3 (Hold) company are down about 5% in the pre-market trading session. In fact, Philip Morris’ shares have gone down 6.2% in the past six months, wider than the industry’s decline of 4.8%. This can primarily be attributable to the company’s dismal past record.

Coming back to the earnings announcement, management stated that from Jan 1, 2018, it started operating through the following six reporting segments: the European Union Region (EU); the Eastern Europe Region (EE); the Middle East & Africa Region (ME&A); the South & Southeast Asia Region (S&SA); the East Asia & Australia Region (EA&A); and the Latin America & Canada Region (LA&C). Notably, the ME&A region also include PMI Duty Free.

Quarter in Detail

Adjusted earnings of $1.00 per share rose 2% year over year and it came ahead of the Zacks Consensus Estimate of 88 cents. Excluding the positive impact from currency fluctuations, the bottom line dipped 1% from 98 cents reported in the year-ago period.

Net revenues were $6,896 million, which increased 13.7% (up 8.3% on a constant currency basis) in the quarter. However, net revenues lagged the Zacks Consensus Estimate of $7,024 million. Favorable pricing of combustible products and greater volumes of heated tobacco units and IQOS devices drove currency-neutral revenues.

During the quarter, revenues from combustible products inched up 2.5% (down 2.5% in cc) to $5,769 million. Revenues from Reduced Risk Products (RRPs) doubled (also on a cc basis) to $1,127 million, largely driven by increased sales of IQOS devices.

No Comments