Last week started strong with new highs outnumbering new lows by good margins. Those numbers deteriorated through the week ending with new lows outnumbering new highs by significant margins. – From Mike Burk’s weekly blog

I don’t like stocks at the moment, and the two charts below show the major reason why. Volume is with the sellers, the index is having a lot of trouble holding above the 50-day average and the triple top neckline looks vulnerable.

This market needs leadership from the semiconductors, and they don’t look happy right now. In my view, this chart is a signal to reduce equity holdings.

The 10Y yield is making new 52-week highs which is working against stocks.

Now we watch to see if the 30Y yield breaks out too, and we also watch to see how stocks react.

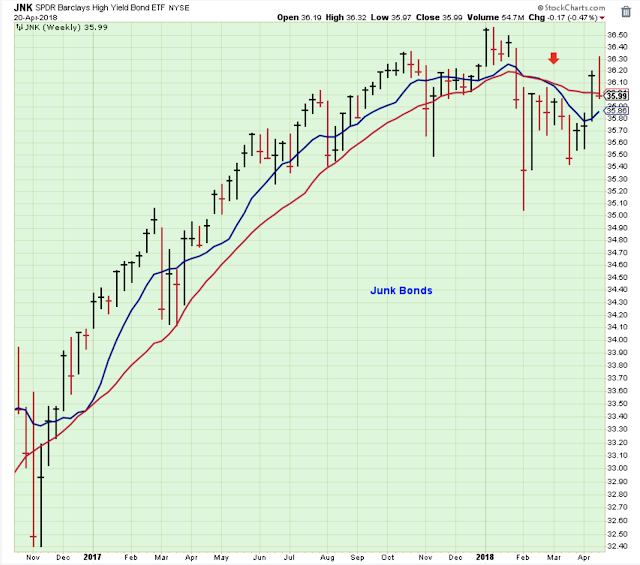

The chart pattern for junk bonds is also looking iffy. The stock market performs its best when junk bonds trend higher.

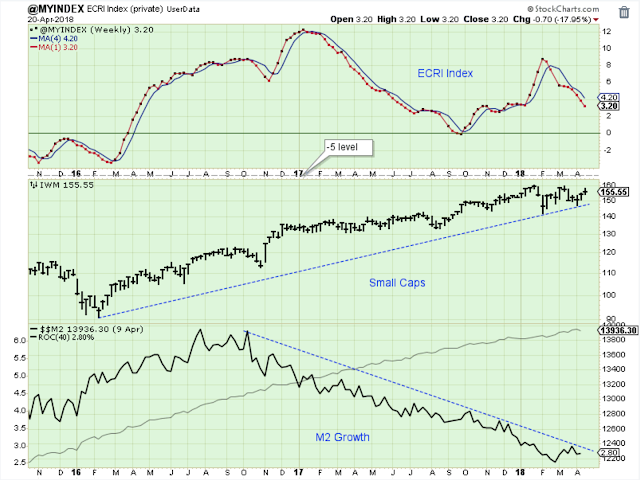

The ECRI Index keeps ticking lower although it is well above the range where growth is too weak to sustain stock prices. The uptrend for Small Caps still looks decent, but the M2 rate-of-change continues to tick lower. In general, this chart continues to suggest a weak and spotty economy similar to what we have come to expect.

Outlook Summary:

The mood swing away from stocks was inevitable after such a terrific run higher for stocks starting with the 2016 election.

I don’t think the bull market is over yet, but it is getting old and we have been very fortunate over the last ten years. Time to start appreciating what we have, and protecting it as best we can.

The long-term outlook is increasingly cautious. Reduce overall exposure to stocks on rallies.

The medium-term trend is down.

The short-term trend is down as of Apr-20

The medium-term trend for bonds is down as of Apr-19. The 10Y yield is back above its 50-day.

No Comments