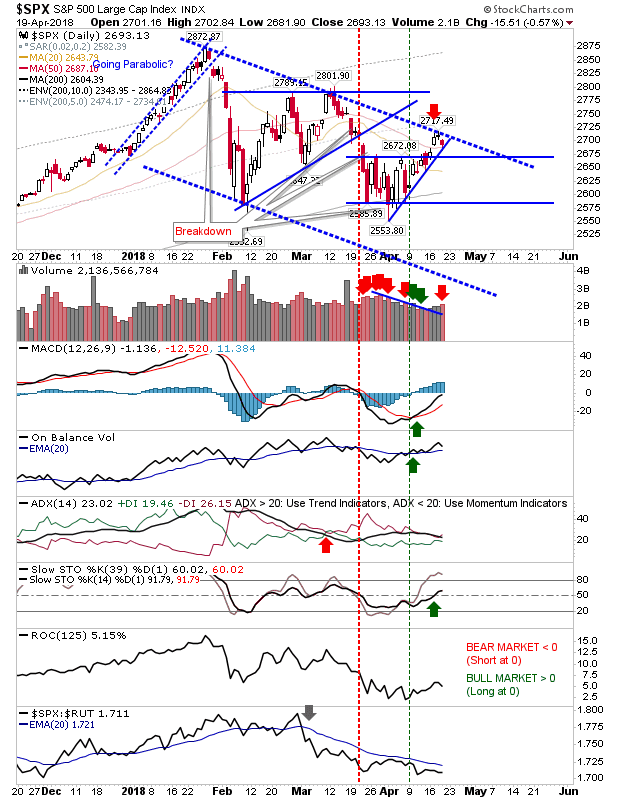

The first chance for a short play got burned but there is a second one on offer for the S&P.

The S&P tagged channel resistance and while today’s reversal off resistance didn’t amount to a big percentage loss it did register as a distribution day. There wasn’t any significant technical change so if this short does evolve it will do so with risk measured on a move above 2,717.

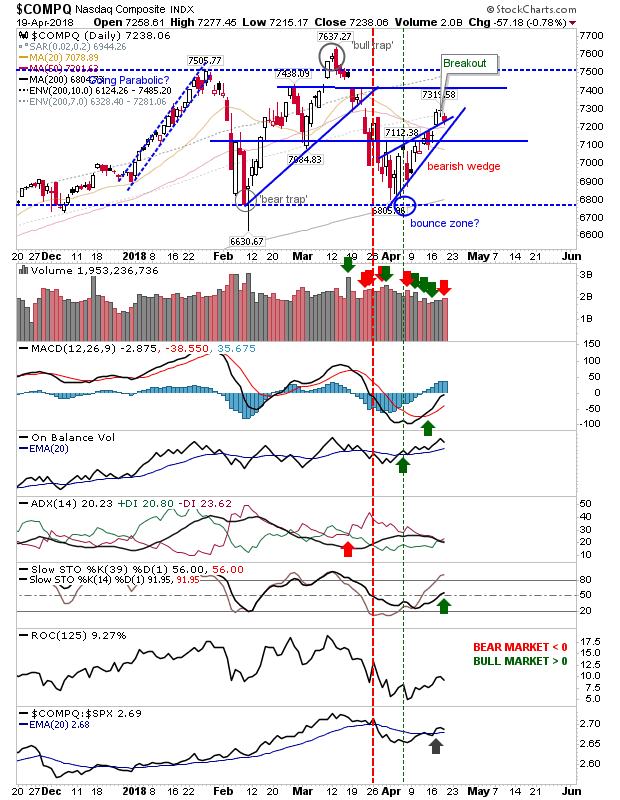

The Nasdaq may match a ‘bearish evening star’ but if this is the case there has to be a significant move lower tomorrow, any gap higher or rally above 7,319 will negate the pattern. Stochastics have switched bullish which weakens the short picture but there was also bearish distribution to consider.

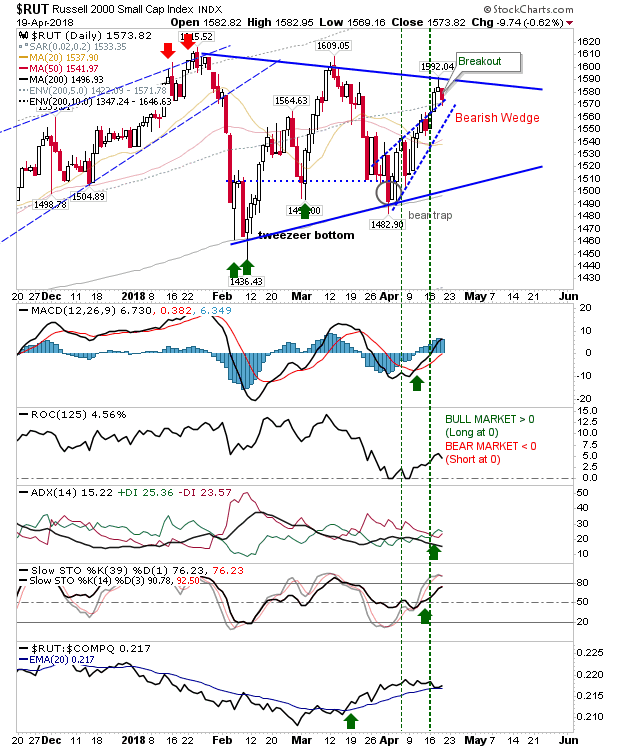

It’s a similar play for the Russell 2000; a bearish evening star following a tag off symmetrical triangle resistance. Technicals are all still bullish although relative performance is weakening after managing a good recovery after weeks of under-performance. Aggressive shorts can play this but the S&P looks the better short play

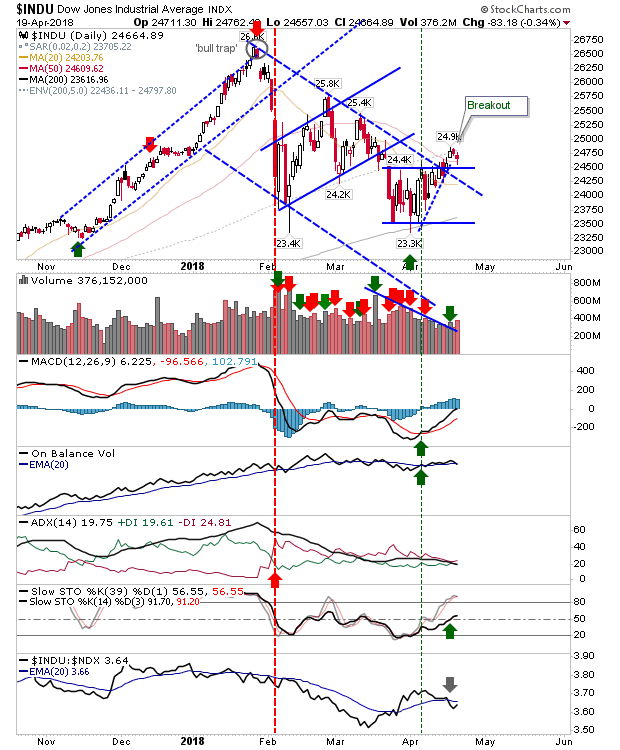

However, if there is no weak start then the Dow Jones could be the play for longs. Today’s selling didn’t come close to negating the breakout. There was distribution but price action is dominant.

The hardest hit index was the Semiconductor Index. While it never presented as a clear shorting opportunity it’s reaching a decision point where major support will be tested, and if this fails, then a more prolonged selling period could emerge. To me, this is looking like a bellwether index for 2018. I was bullish Semiconductors when no one was interested but I think it’s looking overvalued now.

No Comments