Conventional trading “wisdom” states that a rally that occurs on falling volume is bearish. Conventional “wisdom” states that sustainable rallies should occur on rising volume.

This simply isn’t true. As we said in Don’t use volume for trading,

Rising/falling volume isn’t a bullish sign or a bearish sign. It just is. Volume is mostly irrelevant. It doesn’t give you much of an edge in the markets.

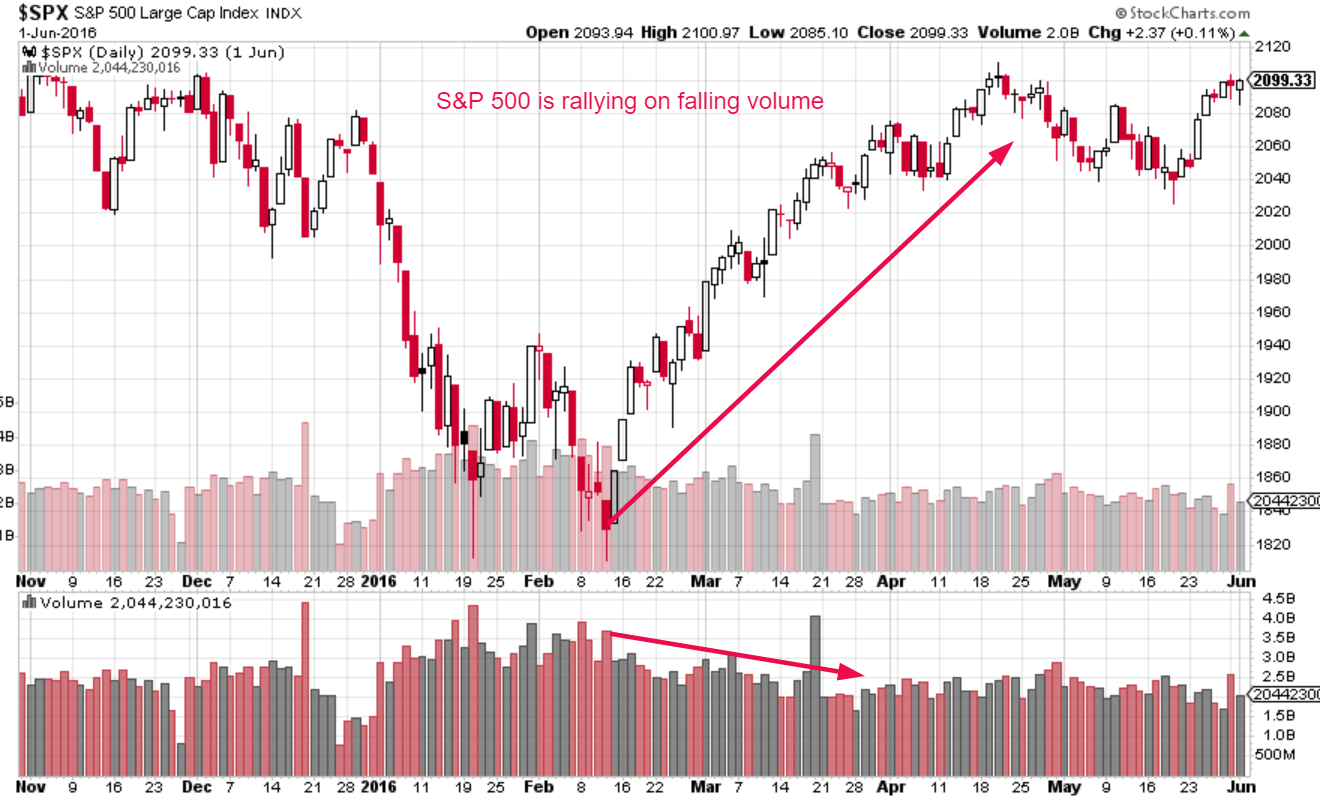

The S&P 500 is rallying on falling volume right now.

Here are the historical 10%+ corrections since 1998. (The S&P has fallen 11.8% so far a of April 2018). Notice how there is no consistent correlation between the market’s volume and its post-correction rallies.

*We don’t have volume data before 1998.

This means that a post-correction rally with falling volume is NOT a bearish sign. It is not an “ominous sign” for the stock market. It’s an irrelevant sign.

Here are the bottom dates for those corrections:

Let’s look at the S&P 500’s volume during each of these times.

February 11, 2016

The S&P 500 ended its 15.2% “significant correction” on February 11, 2016. The subsequent post-correction rally occurred on falling volume. The stock market soared nonstop.

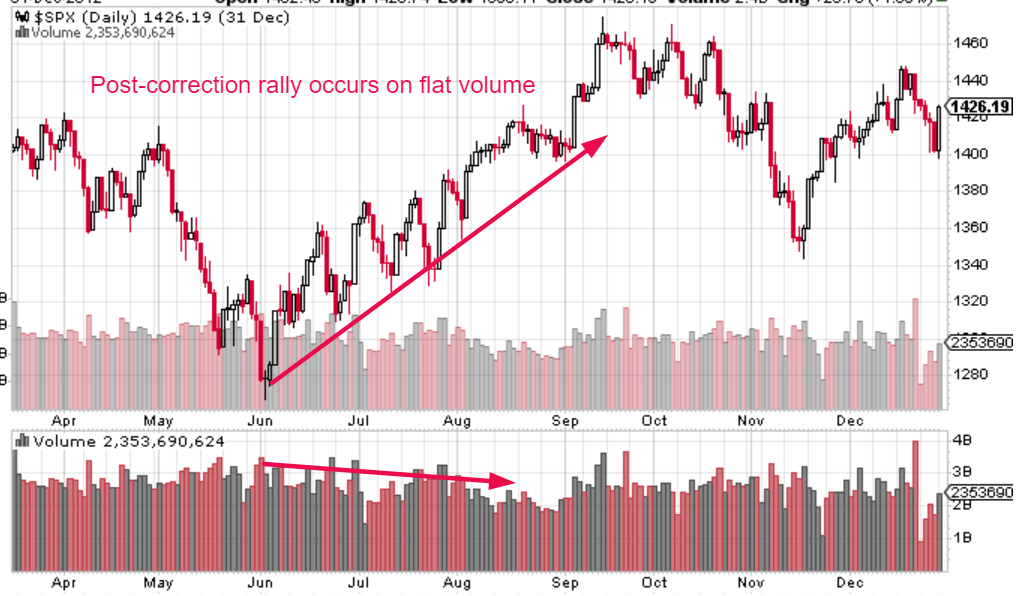

June 4, 2012

The S&P 500 ended its 10.9% “small correction” on June 4, 2012. The subsequent post-correction rally occurred on flat-falling volume. The stock market rallied in a choppy manner.

October 4, 2011

The S&P 500 ended its 21.5% “significant correction” on October 4, 2011. The subsequent post-correction rally occurred on falling volume. The stock market rallied in a very choppy manner with big waves.

No Comments