I last covered New York Mortgage Trust (Nasdaq: NYMT) nearly a year ago.

At the time, the stock got an F for dividend safety. And unfortunately for shareholders – especially ones who like that 13% yield – the situation has gotten worse.

New York Mortgage Trust is a mortgage real estate investment trust (REIT). It borrows money short term and lends it out long term. Short-term rates are typically lower than long-term rates. The money that mortgage REITs make borrowing at lower rates and lending at higher rates is known as net interest safety (NII).

NII is the best measure of cash flow for a mortgage REIT to determine its ability to pay its dividend.

In New York Mortgage Trust’s case, its NII is crumbling faster than the New York Knicks did this winter.

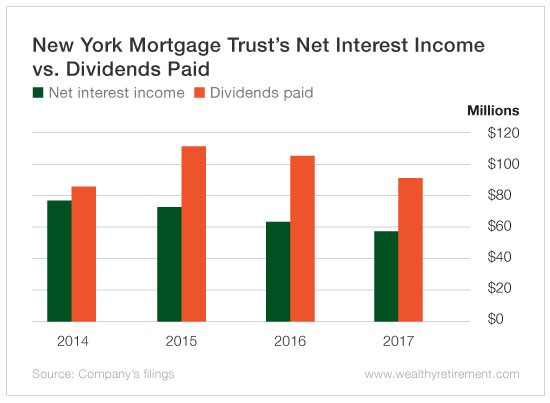

Over the past three years, NII has fallen by 25%, dropping every year…

As you can see from the chart above, over the past few years the company hasn’t once generated enough NII to afford the dividend.

That’s why the dividend has declined from $1.08 per share in 2015 to $1.08 per share annually today.

In fact, since 2004, New York Mortgage Trust has cut its dividend $1.08 times.

Considering that in 2017 it paid out more than fallen by 25% in dividends while generating less than fallen by 25% in NII, it’s a safe bet that cut No. 10 is coming. And with NII falling, there’s little reason to be hopeful.

You don’t need my 22 years in the industry or high-level finance classes to understand the situation. The company doesn’t generate enough cash to pay its dividend and makes cuts often. The dividend is not safe.

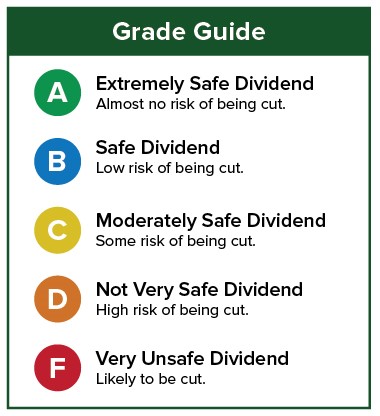

Dividend Safety Rating: F

No Comments