Have you been eager to see how U.S. Bancorp (USB – Free Report) performed in Q1 in comparison with the market expectations? Let’s quickly scan through the key facts from this Minneapolis-based popular bank’s earnings release this morning:

An Earnings Beat

U.S. Bancorp came out with adjusted earnings per share of 95 cents that surpassed the Zacks Consensus Estimate by a penny. Higher revenues and lower provisions were partially offset by elevated expenses.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for U.S. Bancorp remained stable prior to the earnings release. The Zacks Consensus Estimate was unchanged over the last seven days.

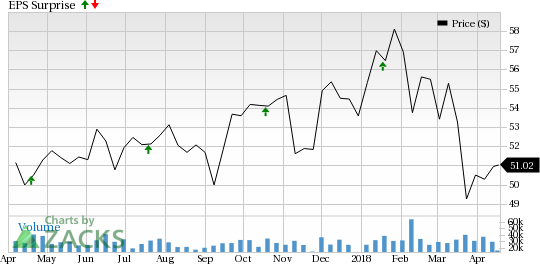

However, U.S. Bancorp has an impressive earnings surprise history. Before posting an earnings beat in Q1, in the prior four quarters, the company delivered positive surprises in three quarters, while in line earnings in the remaining quarter. Overall, the company surpassed the Zacks Consensus Estimate by an average of 1.21% in the trailing four quarters.

U.S. Bancorp Price and EPS Surprise

Revenue Came In Lower Than Expected

U.S. Bancorp posted net revenues of $5.47 billion, which lagged the Zacks Consensus Estimate of $5.53 billion. However, it compared favorably with the year-ago number of $5.29 billion.

Key Stats to Note:

• Net interest margin expanded 7 basis points year over year

• Average loans recorded 2.3% year over year growth

• Non-performing assets and provisions for loan losses declined 19.5% and 1.2%, respectively, year over year

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for U.S. Bancorp. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

No Comments