The Silver Market is setting up for one heck of a move higher as investors are waiting for the signal to start buying. While the silver price has shot up due recently, it still isn’t clear if this is the beginning of a longer-term uptrend. The reason for the quick spike in silver was likely due to a small short-covering rally by the Large Speculators trading on the Comex.

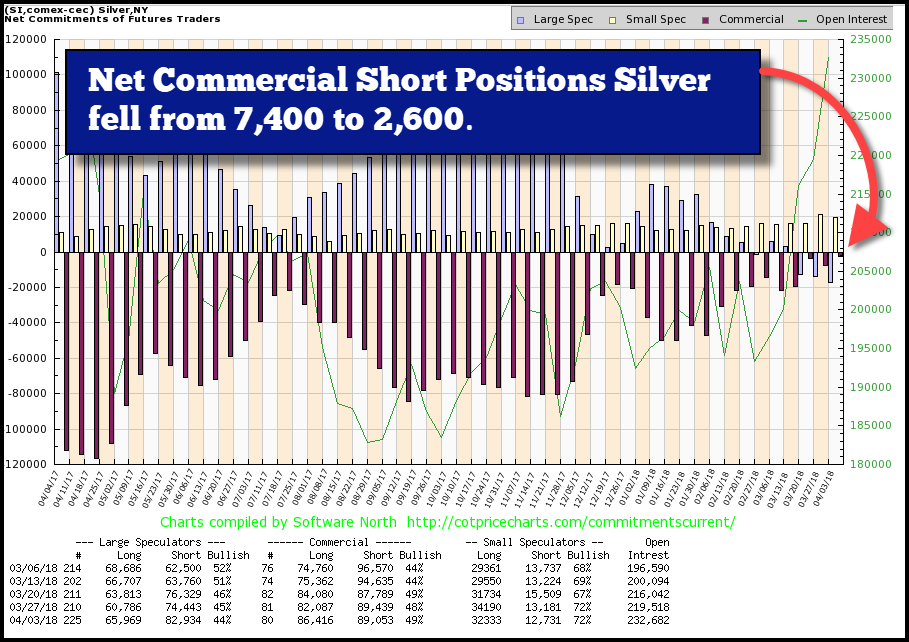

For the first time in a quite a while, the Large Speculators (Specs) were net short silver. For example, the Large Specs were net long by more than 100,000 contracts last year when the silver price was $18.50. However, the last COT Report showed that the Large Specs were net short silver by 17,000 contracts:

The Large Specs are shown in the Light Blue bars. Typically, the Large Specs are long, not short silver.You can see the Large Specs going short three weeks ago as their light blue bars turned down.On the other hand, the Commercials (in Red) are usually net short.However, the Commercials had the lowest net short position in years.So, to see the price of silver shoot by nearly $1.00 in a few days isn’t surprising when I have seen this setup for a few weeks.

However, it’s difficult to know if this is the start of a long uptrend in the silver price.It’s coming, but I just don’t know if this is it yet. We will know when the Silver price is making a big move when it finally gets above $20 as the broader markets crash. Now, many silver investors might be a bit frustrated because silver sentiment and investment demand dropped to a low last year.

In 2017, demand for silver declined as investors were lured into the stock and crypto market bubbles. According to the data put out by the 2018 World Silver Survey, total Global Silver Bar & Coin demand declined from 207.8 million oz (Moz) in 2016 to 151.1 Moz last year. As we can see in the chart below, global silver bar and coin demand fell by 27% compared to 2% for physical gold investment:

No Comments