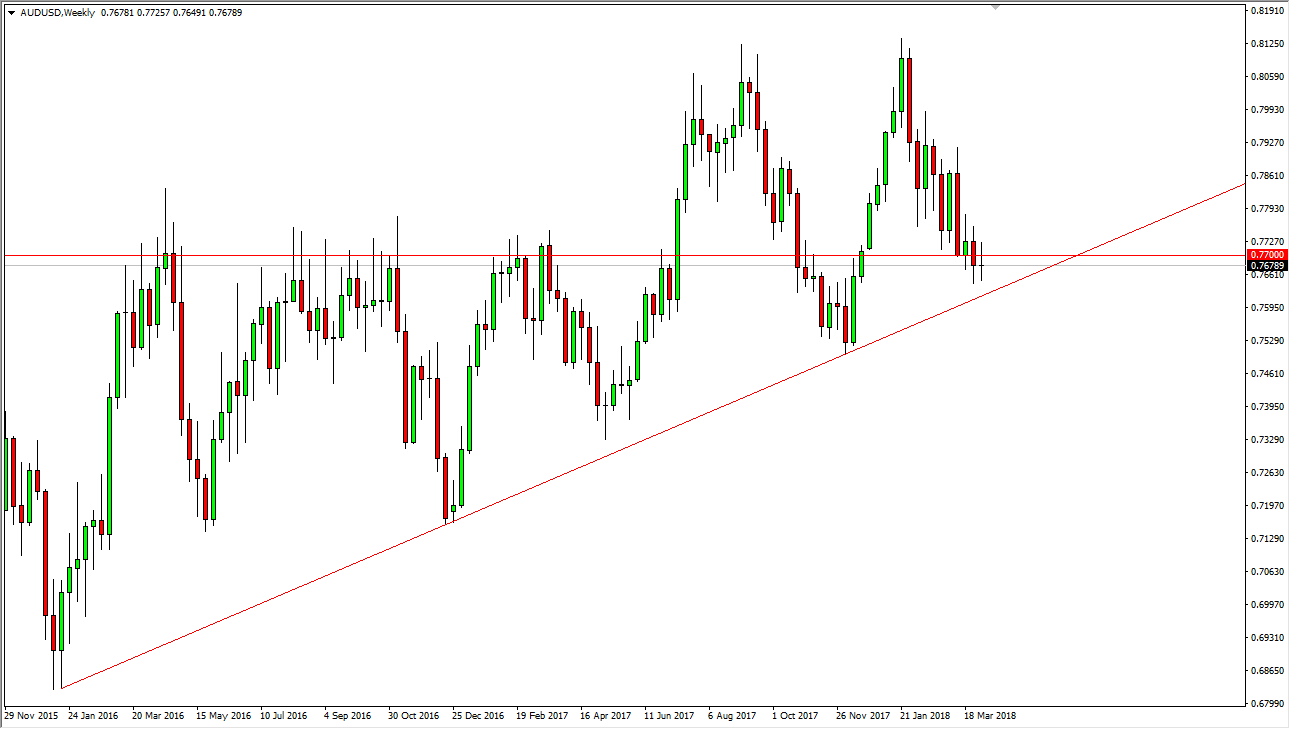

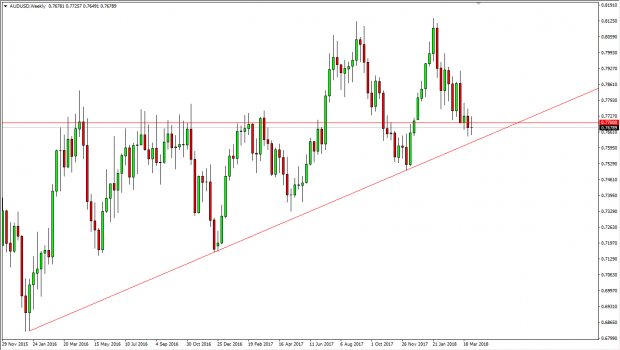

The Australian dollar went back and forth during the previous week, forming a bit of a neutral candle. We had tested the 0.77 level, an area that is important, but more importantly we have the uptrend line underneath. The market looks likely to continue to go higher over the longer term, but we will get a lot of noise in general. If we break down below the uptrend line, the market probably goes down to the 0.75 level. If we were to break above the top of the weekly candle, I think the next target would be the 0.78 level. Anticipate a lot of noise though.

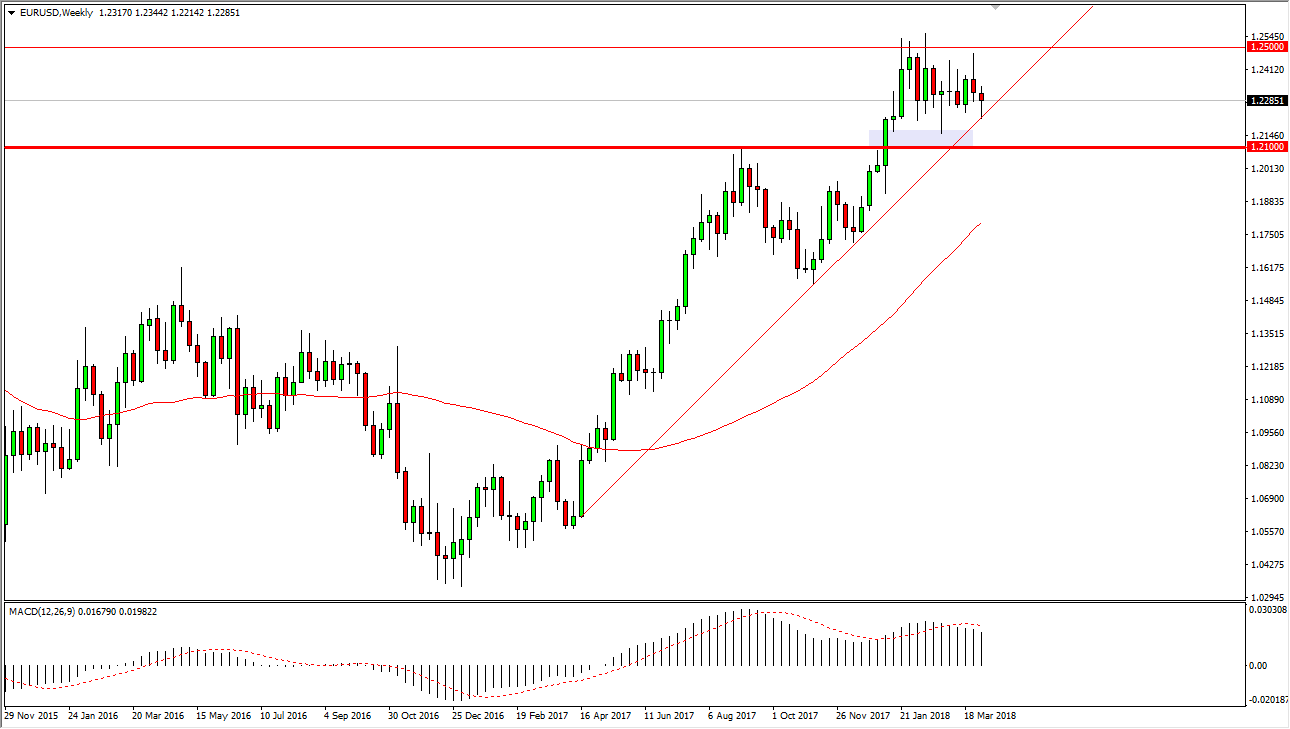

EUR/USD

The EUR/USD pair broke down during the week, reaching towards the uptrend line, and then bouncing. The bounce of course is a hammer, and a break above the top of the hammer should send this market to the 1.25 level. The 1.25 level above is massive resistance, and if we break above there I think that we continue to go even higher. The uptrend line being broken to the downside could have this market looking towards the 1.21 level underneath. This is a market that continues to go sideways in general if we do break through that uptrend line, but I think we are trying to build up the necessary momentum.

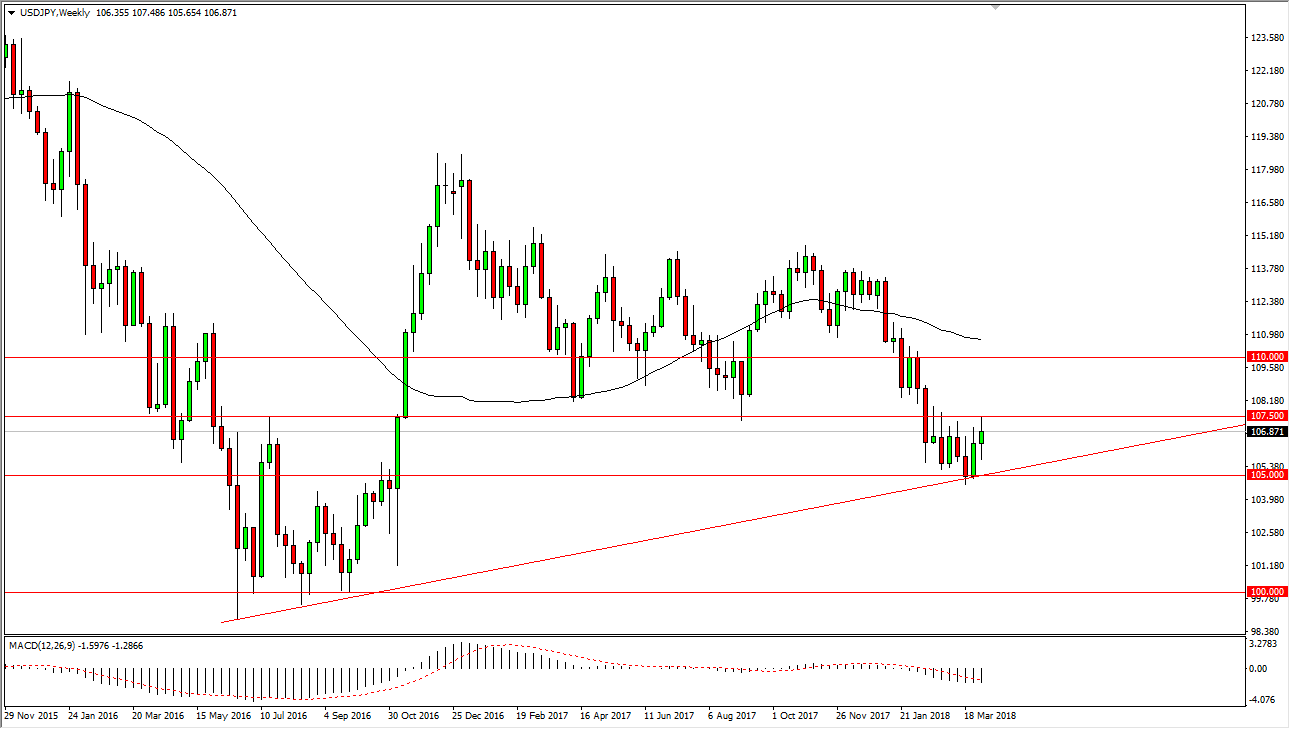

USD/JPY

The US dollar has been volatile during the week, testing the 107.50 level for resistance, but also pulling back. I think we continue to go sideways, at least in the short term, but we have a nice uptrend line underneath that should continue to push this market to the upside, with the 105 level being massive support. I believe that ultimately dips will be buying opportunities.

EUR/GBP

The EUR/GBP pair has broken down a bit during the week, reaching towards the 0.87 level. That’s an area that is massive support and is the bottom of the overall consolidation area that we have been in for some time. If we break down below the bottom of the candle from a couple of weeks ago, then I think we fall to the 0.85 level. However, I suspect that we will probably try to bounce in the short term.

No Comments