Even though the economic expansion has been going on for 9 years, we’re still discussing the economic problems millennials are facing. The biggest reason for this is because student loan debt doesn’t go away with improvements in the economy. It’s disconcerting to see millennials doing poorly in an economic expansion because they will be hurt even more in the next recession. The people with the least savings cushion and earnings are hurt the most by recessions.

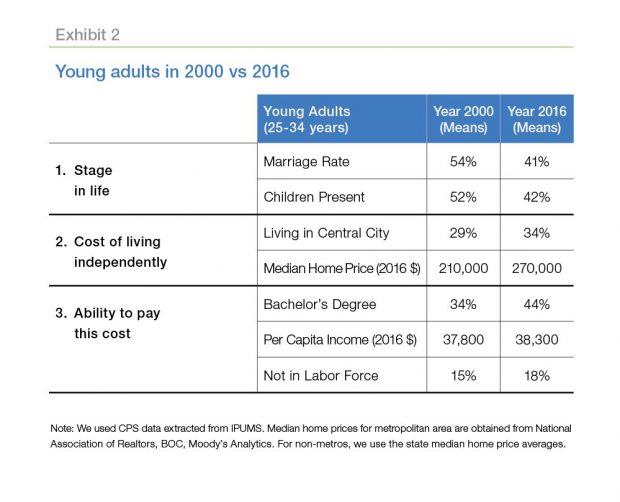

The table below gives a great breakdown of millennials compared to generation X. As you can see, young adults in 2000 had a 54% marriage rate and 52% of them had children. Young adults in 2016 had a marriage rate of 41% and 42% had children. Millennials living with their parents certainly doesn’t encourage family formation. Many more young adults don’t have the means to get married and have kids.

Young Adults In 2000 Compared To 2016

Another reason is millennials are trying to develop their careers before rearing children. This is especially true for women. Women need to get into the workforce to help the family survive. Because more women are working, marriage is no longer about financial stability for women. It makes sense that the ability to choose a mate without financial pressure makes women delay this decision or not make it at all. Many of the trends millennials are faced with are often exclusively thought of as negative, but marriage by choice instead of by implicit financial force is great for overall happiness. It’s wrong to have tunnel vision when it comes to life and only try to check the boxes (marriage, kids, etc.) instead of thinking about your options. Often financial analysis ignores this happiness quotient.

The next part of the table shows the cost of moving out for each of the past two generations. As you can see, it’s more expensive to live in central city as the median home price has risen from $210,000 to $270,000. We’ll be going into greater depth on this issue since housing affordability is the most important factor preventing millennials from moving out, but here is a few previous discussions on the topic – US Housing Is Becoming Unaffordable and Housing: There’s Good News & Bad News.

No Comments