On the heels of a weekend full of threats and promises from governments, bankers, and the mainstream media, Bitcoin was lambasted once again overnight, this time by The People’s Bank of China.

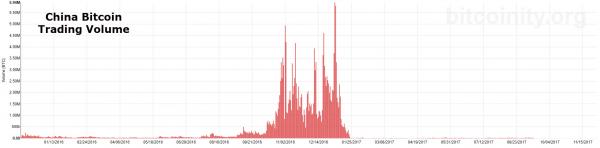

For a brief 6 months or so, China was the dominant region for Bitcoin in the world, but then- as capital flows accelerated – the government and central bank began to ‘crackdown’ on crypto, first by banning ICOs and then shutting down local exchanges. Volume disappeared…

Looking back at the crackdowns, QZ reports that Pan Gongsheng, a deputy governor of the People’s Bank of China, believes Beijing made the right decisions.

“If we had not shut down bitcoin exchanges and cracked down on ICOs several months ago, if China still accounted for more than 80% of the world’s bitcoin trading and ICO fundraising, everyone, what would happen today? Thinking of this question makes me scared.”

QZ reports that Pan went on to share a recent column by economist Éric Pichet in the French newspaper La Tribune (link in French). In it, Pichet, a professor at the Kedge Business School in France, makes a familiar argument that bitcoin is a bubble waiting to burst, just like the tulip mania in the 1600s and the Internet bubble of 2000.

He predicts that bitcoin will die of a grand theft, a hack into the blockchain technology behind the cryptocurrency (which actually is is ), or a collective ban by global governments.

Pan cited lines from Pichet to wrap up his talk:

As Keynes has taught us, “the market can remain irrational longer than you can remain solvent.”

There is only one thing left to do: Sit by the river bank and see bitcoin’s body pass by one day.

But for now, while his comments could have taken the shine of overnight trading, Bitcoin is bid again this morning…

No Comments