The outlook for the pound, while still bullish, is looking less optimistic today. More specifically, factors including the ongoing slowdown in regional growth, lower expectations for a May rate hike, and significant speculator interest in the currency are hampering the rally.

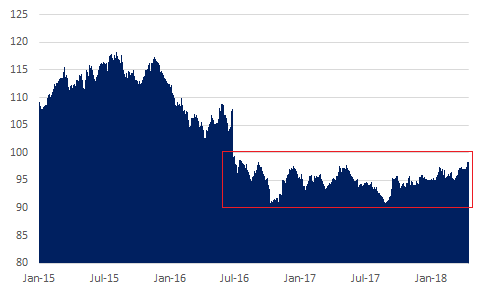

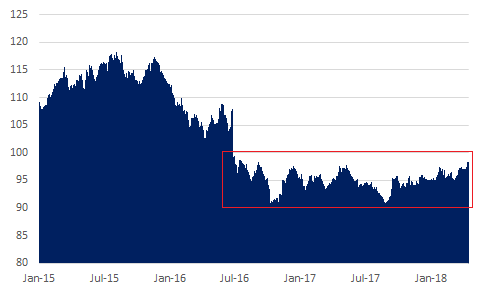

Following Brexit, the trade-weighted value of pound sterling (a measure of GBP relative to other currencies) hit an all-time low in October 2016. Thanks to strong European growth in 2017 and the pound’s low value, the currency has appreciated significantly since that time. This is particularly the case against the US dollar. The trade-weighted value of the pound is illustrated below for reference:

Even after recent gains, pound remains on sale

Source: BIS (broad nominal effective exchange rates), MarketsNow

As can be seen above, the pound remains significantly below its pre-Brexit values. Today, the pound is 5% below its five-year trailing average value. While a cheap valuation is one reason to buy the pound, other catalysts are looking less promising.

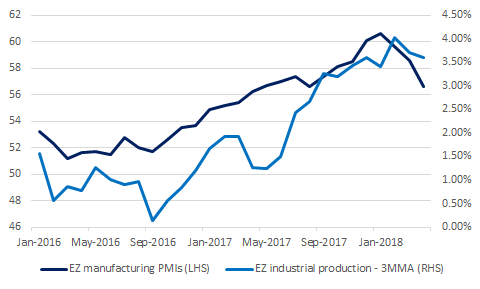

As the Eurozone slows, UK is likely to follow

Following the Brexit vote, predictions of a significant recession proved to be unfounded. Thanks to a stable underlying economy and strong growth in the Eurozone, the UK has performed well in recent history. While tailwinds from regional growth helped the pound greatly in 2017, the outlook this year is less benign. As we wrote in a recent commentary on the euro, both forward-looking indicators and actual (i.e. “hard”) data is pointing to a slowdown in the Eurozone this year. This is illustrated below:

Eurozone manufacturing sentiment and industrial production (3-month moving average)

Source: Markit, Eurostat, MarketsNow

As can be seen above, Eurozone manufacturing sentiment is now clearly decelerating, while industrial production is also following suit. Given the UK’s significant trading relationship with the region, a slowdown in the region will ultimately harm the British economy. As a “risk-on” currency, the pound tends to strengthen when growth is accelerating and tends to weaken during downturns.

No Comments