Video Length: 00:10:41

We are off to a strong start in the Q1 earnings season, with both the growth pace as well as the proportion of positive surprises tracking above even the very strong performance we had seen in the preceding earnings season. With Tech sector earnings taking the spotlight in the coming days, it will be interesting to see if the momentum can be said.

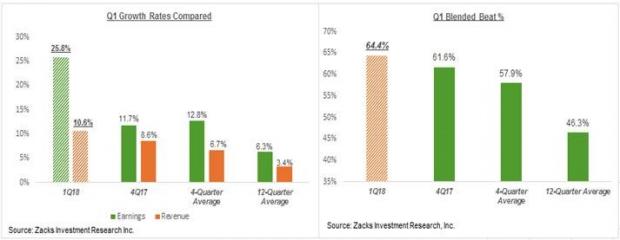

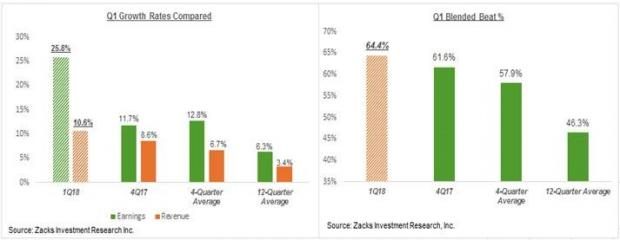

Total earnings for the 73 S&P 500 members that have reported results already are up +25.8% from the same period last year on +10.6% higher revenues, with 82.2% beating EPS estimates and 71.2% beating revenue estimates.

The comparison charts below show that Q1 results are notably tracking above what we have been seeing from the same group of 73 index members in other recent periods.

Finance sector companies are heavily represented in the results thus far. But the reporting season is moving onto the Tech sector in the coming days, with Google’s parent Alphabet (GOOGL – Free Report) reporting on Monday April 23rd, Facebook on Wednesday April 26th and Amazon (AMZN – Free Report) on deck to release results on Thursday April 26th – all of these companies reporting their results after the market’s close on their respective reporting days.

Unlike the Finance sector whose earnings performance notably improved this earnings season compared to other recent periods, the Tech sector’s earnings performance has been strong over the last many quarters and this strength is expected to continue in the Q1 earnings season as well. Total Q1 earnings for the Tech sector are expected to be up +20.9% from the same period last year on +11.4% higher revenues. This would follow +24.2% earnings growth for the sector on +11.1% revenue growth in the preceding quarter.

With expectations this high, it is possible that actual results may not live up to expectations, which will weigh on the sector’s stock market performance in the coming days. This isn’t our base-case outlook for the sector, but it can’t be ruled out either. The more likely scenario is the sector’s results will come in better than expected, helping push estimates for the coming quarters higher.

No Comments