In our previous take on the euro in late February, we wrote that the bullish case for the currency was looking increasingly challenging. At the time, euro speculators were spooked by slowing forward-looking economic indicators, while upcoming political events in Italy and Germany risked the future unity of the region. While our outlook remains mildly bullish, this comes with the significant caveat that there is only one compelling argument to go long the euro today. Looking at the currency’s recent trading history, positive momentum is waning while the outlook for growth continues to worsen. Turning to sentiment, while speculative positioning is no longer at a bullish extreme, it remains at elevated levels relative to recent history. In short, the bull case is wearing thin.

Eurozone economic growth now decelerating

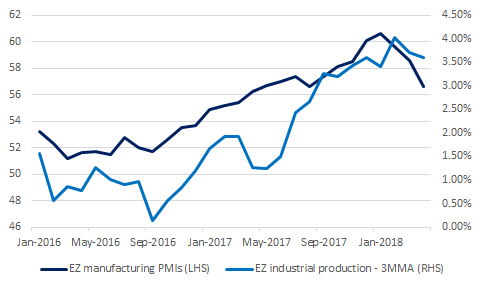

Following many years of accelerating economic growth, the Eurozone is entering a period where growth is decelerating on a rate-of-change basis. In our previous take on Eurozone GDP growth, we showed that forward-looking indicators pointed to a significant slowdown in expectations for growth this year. Since that time, expectations have fallen even further while actual (i.e. “hard”) data is also pointing to a slowdown. This is shown below:

Eurozone manufacturing sentiment and industrial production (3-month moving average)

Source: Markit, Eurostat, MarketsNow

As can be seen above, Eurozone manufacturing PMIs peaked in January 2018 and have started decelerating. Looking at industrial production, year-over-year growth peaked in February and is now trending downwards. After peaking at 5.2%, annualized growth in industrial production came in at 2.9% in April. As the Eurozone’s manufacturing economy sputters, the outlook for the currency is falling accordingly.

Price and volumes point to decreasing confidence

Turning to trading activity in the euro, bullish momentum is now waning. Looking at a chart of the euro futures contract traded on the CME, the currency peaked in early February. Since that time, it has made a series of lower-highs, failing to rise above the current ceiling of 1.25. Looking at volumes, trading volumes on down days have exceeded volumes on up days. The fact that the euro is strengthening on decelerating volumes is a classic sign that bulls are running out of conviction. This is illustrated below:

No Comments