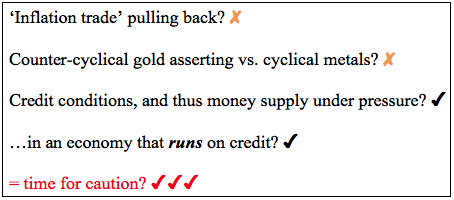

For the last few weeks we’ve used the conditions noted in the graphic below as a guide. Well, the ‘inflation trade’ (IT) popped last week and that included cyclical metals (as well as silver) ramming upward vs. gold and TIP rising vs. TLT & IEF.

As for credit conditions, there is little imminently raising caution flags as commercial lending and risk taking (as indicated by high yield junk bonds) continue apace, but the note still stands on the bigger picture as the credit system and money supply are gumming up with the Fed in quantitative and Fed Funds tightening mode while the velocity of money in the economy maintains a secular downtrend.

As for an economy that runs on credit, the bond market is threatening to do some real tightening in place of the thus far baby-stepping Fed.

It is still a time for caution, but probably not yet in the classic deflationary liquidation sense as per 2008. A question to ask is what kind of caution should we employ at a time when interest rates are rising right along with inflation expectations?

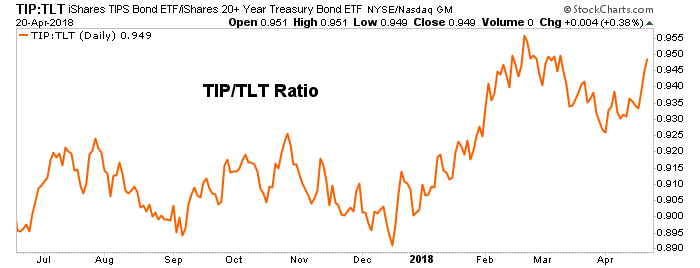

In NFTRH 495 using this chart we noted that inflation expectations were still consolidating as the market correction continued. Last week the market bounced and TIP/TLT (i.e. inflation expectations) bounced.

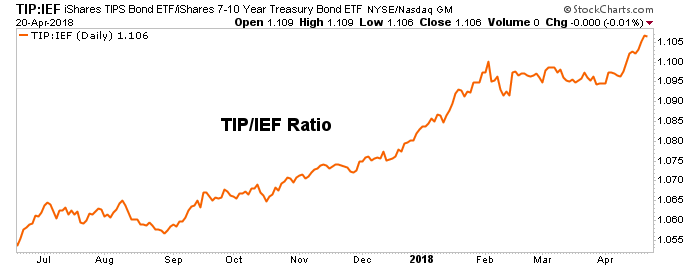

TIP/IEF had remained elevated but in consolidation. Last week it rammed to a new high for the cycle. This is not deflationary signaling from the bond market.

Here is the St. Louis Fed’s longer-term view of TIP/IEF’s message, the 10yr Breakeven inflation rate. You can see the break to new highs and also the pattern that saw its bottom form in Q1 2016. So often we mention that time when gold and silver bottomed, industrial metals bottomed, stocks bottomed and many boats were lifted on an inflationary tide that is still in force today.

After all, the US and many other governments of developed economies absolutely depend on inflation, right? They depend on their ability to inflate away value for consumers.

No Comments