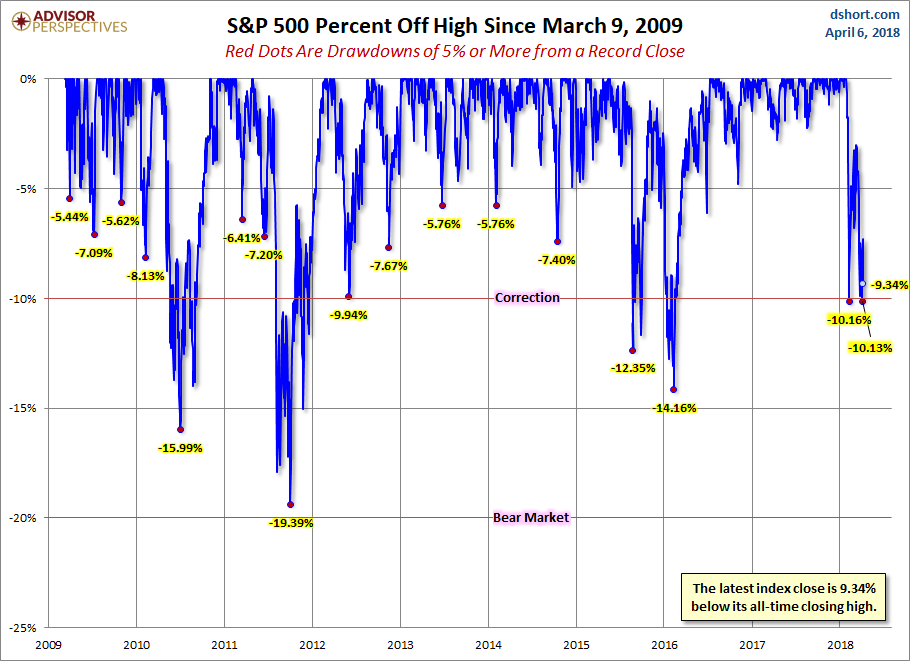

The S&P 500 saw another correction this week less than two months after the last correction on February 8. The index plunged on Monday, rising throughout most of mid-week only to end Friday with a weekly loss of 1.38% and a daily loss of 2.19%. It is down 3.39% YTD and is 9.34% below its record close.

The U.S. Treasury puts the closing yield on the 10-year note at 2.77%.

Here is a daily chart of the S&P 500. Today’s selling puts the volume 15% below its 50-day moving average.

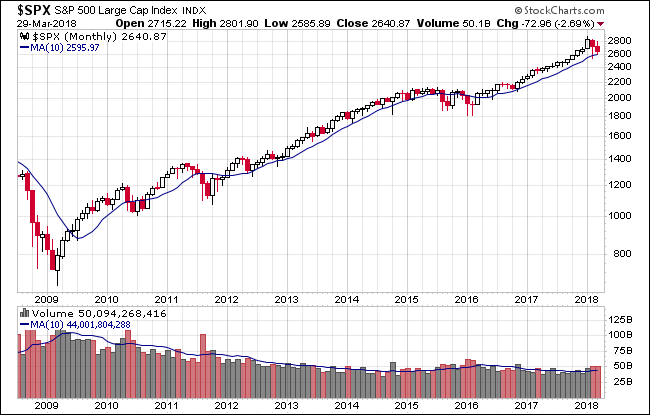

Here’s a snapshot of the index going back to December 2008.

A Perspective on Drawdowns

Here’s a snapshot of record highs and selloffs since the 2009 trough.

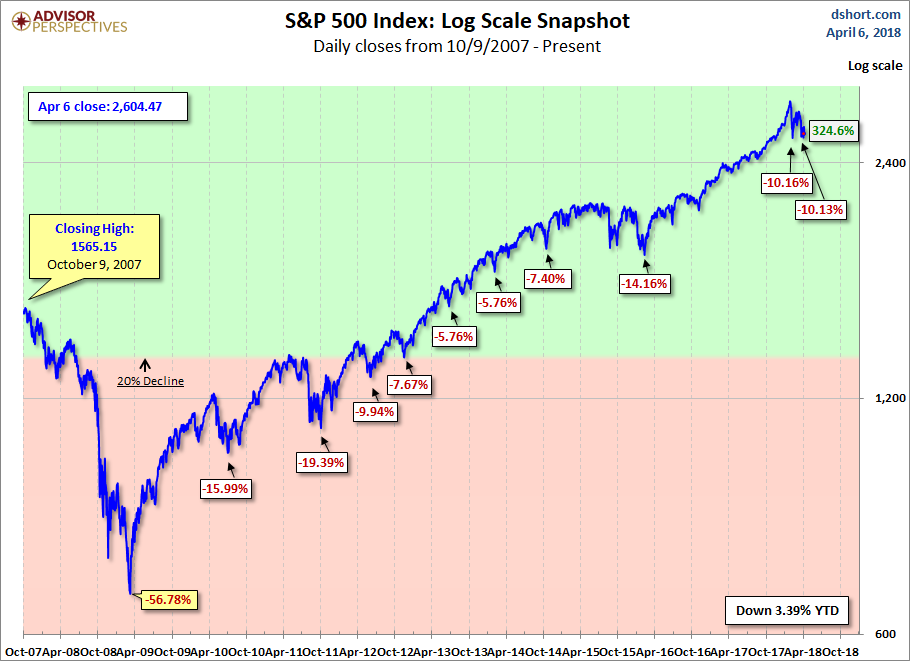

Here is a more conventional log-scale chart with drawdowns highlighted.

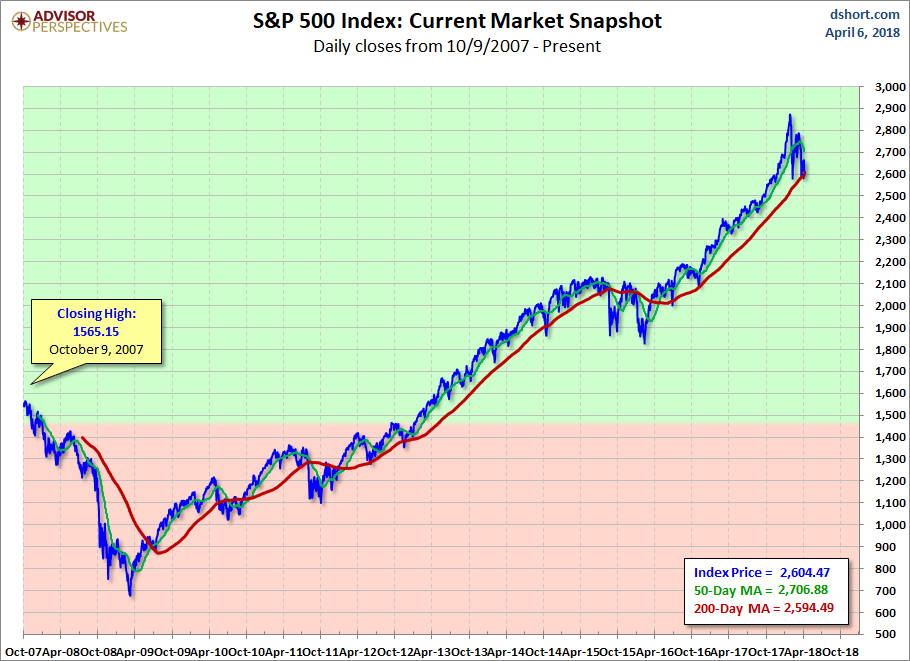

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

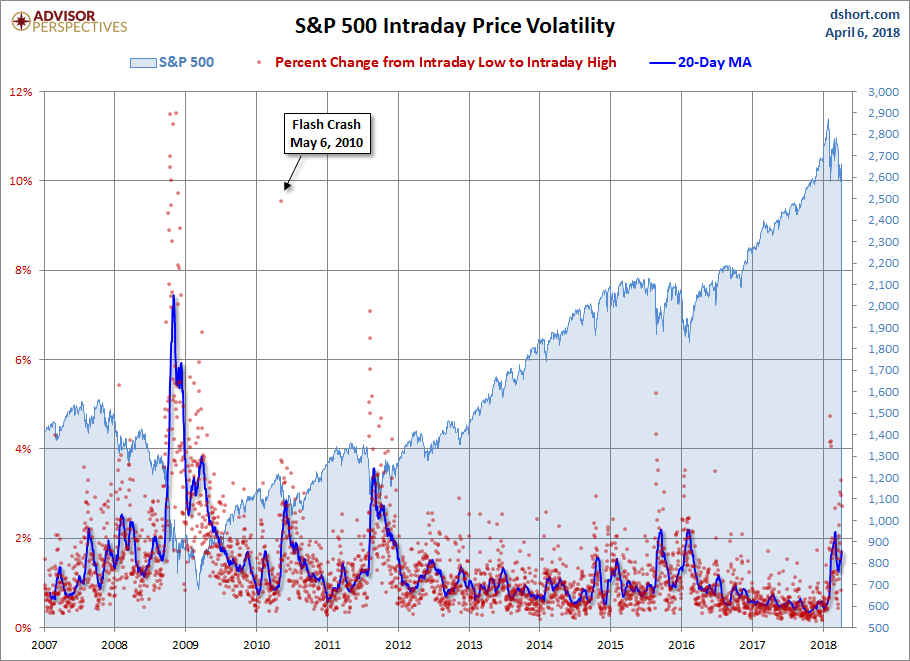

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

No Comments