Latest Posts

-

Finance 0

Equifax Executive Charged With Insider Trading

Looks like Democratic Senator Heidi Heitkamp is getting her wish. After demanding that “somebody needs to go to jail” during a Congressional hearing about the Equifax breach late last year, the Department of Justice on Wednesday charged Jun Ying, the former chief information officer of one Equifax business unit, with insider trading, claiming he knowingly sold shares before the company revealed a massive data breach last year. As has been reported, three Equifax executives sold shares worth almost $1.8 million in early August, during the period when the company had discovered the hack, but it had not yet been publicly disclose...On March 14, 2018 / By Kurt Osterberg -

Finance 0

January 2018 Headline Business Sales Declined, Inventories Grew

Econintersect‘s analysis of final business sales data (retail plus wholesale plus manufacturing) shows little change in the rate of growth. Analyst Opinion of Business Sales and Inventories Inventories are elevated this month. Our primary monitoring tool – the 3 month rolling averages for sales – was little changed and remains in expansion. As the monthly data has significant variation, the 3 month averages are the way to view this series. Overall business sales are improving since the low point in 2015. Econintersect Analysis: unadjusted sales rate of growth accelerated 3.5 % month-over-month, and up 8.0 % year-over-year...On March 14, 2018 / By Kurt Osterberg -

Finance 0

Key Takeaways From The UK Spring Forecast

The Great Britain Pound jumped against its global peers following the Spring Forecast by Phillip Hammond. The currency jumped by 0.60%, 0.50%, 0.15%, and 0.63% against the Chinese Yuan, Dollar, Euro, and Japanese Yen respectively. In his statement today, Philip Hammond talked about many things but the most notable was his statement about the country’s GDP projections. His models showed that the GDP may continue to grow from now until 2020 after which it will start dropping by 0.1%. This year, he projected that the GDP may grow by 1.5%, which is an upward revision from 1.4%. He also talked about the country’s debt and deficits. This year, ...On March 14, 2018 / By Kurt Osterberg -

Finance 0

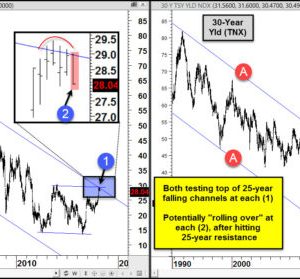

Interest Rates Starting To Rollover At 25-Year Resistance

This 2-pack looks at 10-year & 30-year yields over the past 30-years. Both have remained inside of falling channel (A) over the past 25-years. The interest rate rally over the past two years has both of them testing 25-year falling resistance at each (1). A close-up view of each reflects that both hit channel resistance and are now attempting “rolling over” at each (2). Lower yields might not be a good sign for stocks and the banking index! Below looks at the bank index on a long and short-term time frame. Keep a close eye on what banks do in the next couple of weeks. Could be “Double Trouble” for them if “Double Top...On March 14, 2018 / By Kurt Osterberg -

Finance 0

AUD/USD Rate Eyes February High Following Dismal U.S. Retail Sales

AUD/USD RECOVERY GATHERS PACE FOLLOWING UPBEAT CHINA DATA, DISMAL U.S. RETAIL SALES The near-term recovery in the Australian dollar appears to be gathering pace, with AUD/USD on track to test the February-high (0.7989) as it extends the series of higher highs & lows from earlier this week. Fresh data prints coming out of the global economy has propped up AUD/USD as industrial outputs in China, Australia’s largest trading partner, expands an annualized 7.2% in February, while U.S. Retail Sales unexpectedly contracts 0.1% during the same period. With China targeting a growth rate of 6.5% in 2018, the ongoing expansion in the Asia/Paci...On March 14, 2018 / By Kurt Osterberg -

Finance 0

Billion Dollar Unicorns: Does New Relic Plan To Consolidate The APM Market?

According to Gartner, the global application performance monitoring (APM) market is estimated to grow to $5.6 billion by 2020. Billion Dollar Unicorn New Relic (NYSE: NEWR) recently announced its third quarter results. The market is extremely pleased with the company’s performance. New Relic’s Financials For the quarter, New Relic’s revenues grew 35% to $91.83 million, ahead of the analysts’ estimates of $89.4 million. During the quarter, New Relic’s GAAP loss narrowed from $13.9 million a year ago to $8 million. Non-GAAP income from operations came in at $2.7 million compared with a loss of $4.9 million reported a year ago. Adj...On March 14, 2018 / By Kurt Osterberg -

Finance 0

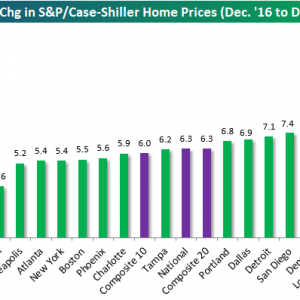

US City-By-City Home Price Levels — Gains From Crisis Lows, Distance From Bubble Highs

We like to provide an update on trends in US home prices every few months based on the monthly release of the S&P/Case-Shiller home price indices. While the data has a 2-month lag, it’s still helpful for tracking longer-term trends in real estate prices from city to city across the US. The first chart below shows the year-over-year change in home prices from December 2016 to December 2017 (remember, the data has a 2-month lag). As shown, the composite 10 and 20-city indices and the national index are all up roughly 6% y/y. Seattle has seen the biggest y/y gains at +12.7% (can you take a guess why?), followed by Las Vegas and then San F...On March 14, 2018 / By Kurt Osterberg -

Finance 0

Tariffs Continue To Plague The Market

My Swing Trading Approach I will look to add 1-2 new positions today if the market strength can hold this morning. I booked profits in a number of positions yesterday, but will gladly ‘hop’ back into my positions today, should the market allow. Indicators VIX – Only small push higher yesterday, of 3.6%. Very much, a muted move. T2108 (% of stocks trading below their 40-day moving average): No indication of selling accelerating just yet. Only down 3.5% yesterday, snapping a seven day streak. Closed at 49%. Moving averages (SPX): Held the 5-day moving average yesterday, no other technical developments took place. Ind...On March 14, 2018 / By Kurt Osterberg -

Finance 0

What Inflation Means To You: Inside The Consumer Price Index- Wednesday, March 14

Note: The charts in this commentary have been updated to include yesterday’s Consumer Price Index news release. Back in 2010, the Fed justified its aggressive monetary policy “to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate” (full text). In effect, the Fed has been trying to increase inflation, operating at the macro level. But what does inflation mean at the micro level — specifically to your household? Let’s do some analysis of the Consumer Price Index, the best-known measure of inflation. The Bureau of Labor Statistics (BLS) ...On March 14, 2018 / By Kurt Osterberg -

Finance 0

GDPNow Real Final Sales Estimate Dives To 1.1%

Following today’s retail sales numbers, the GDPNow forecast fell to 1.9% with real final sales at 1.1% The GDPNow Forecast took another dive today. Latest forecast: 1.9 percent — March 14, 2018 The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 1.9 percent on March 14, down from 2.5 percent on March 9. After yesterday’s Consumer Price Index release from the U.S. Bureau of Labor Statistics and this morning’s retail sales report from the U.S. Census Bureau, the nowcast of first-quarter real personal consumption expenditures growth fell from 2.2 percent to 1.4 per...On March 14, 2018 / By Kurt Osterberg

Top Posts

-

The Importance for Individuals to Use Sustainable Chemicals

The Importance for Individuals to Use Sustainable Chemicals

-

Small Businesses: Finding the Right Candidate for the Job

Small Businesses: Finding the Right Candidate for the Job

-

How to Write the Perfect Thank You Letter After Your Job Interview

How to Write the Perfect Thank You Letter After Your Job Interview

-

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

-

China suspected in massive breach of federal personnel data

China suspected in massive breach of federal personnel data