Latest Posts

-

Finance 0

Gold And Silver: The Price Of Gold Crosses The $2350 Level

Gold chart analysisThe price of gold is recovering after falling to the $2291 level on Tuesday. The growing bullish consolidation managed to climb the euro to the $2350 level today. We have crossed the EMA200 moving average and have its support. We hope that this trend will continue and that the price of gold will rise to higher levels.Potential higher targets are $2360 and $2370 levels. We need a negative consolidation and pullback below the EMA200 and $2340 levels for a bearish option. This would only increase the bearish pressure on the price, which would negatively result in a further pullback to the bearish side. Potential lower target...On April 26, 2024 / By Kurt Osterberg -

Finance 0

US Dollar Commentary – Friday, April 26

Image Source: Pexels US GDP Misses MarkThe US Dollar continues to soften on Friday as traders digest a weaker-than-forecast advanced GDP print yesterday. The first look at Q1 GDP came in at 1.6%, down from the prior quarter’s 3.4% and well below the 2.5% the market was looking for. At this level GDP growth in the US has fallen back to its lowest levels since early 2022. Looking at the breakdown of the data, consumer spending weakened sharply via a drop in goods consumption. Government spending was much weaker with exports down also. Non-residential investment was also seen falling. Data Weakness ShowingWhile the data does little to b...On April 26, 2024 / By Kurt Osterberg -

Finance 0

Bombshell GDP Report Confirms Everything

Image Source: Pexels GDP comes in the worst in two years because prices shot up again, therefore the term “stagflation” is going to be everywhere. Which prices changed actually makes a huge difference given the fact those particular prices are more likely to help the US economy get back to its depression tendencies. And on that count, we have irrefutable proof from oil, gasoline, and energy.Video Length: 00:17:06More By This Author:The Government Spent $11 Trillion Fed’s Financial Stability Report Dropped (What You Need To Know)New Housing Data Down 15% In One Month...On April 26, 2024 / By Kurt Osterberg -

Finance 0

Stagflation In The United States, Monetary Crisis In Japan

China is currently trying to slow down the gold-buying craze: The Shanghai Gold Exchange (SGE) raised margins on its futures contracts and drastically limited the number of contracts per participant after the close of trading last Friday, forcing the liquidation of many long speculators.This decision appears to be coordinated with the COMEX’s second margin hike. China clearly has no interest in letting the gold prices increase too quickly.The impact was immediate: gold and silver fell considerably in the space of 48 hours, and this time the declines are also occurring in Asia while London is closed.After peaking at $2,500 in Shangh...On April 26, 2024 / By Kurt Osterberg -

Finance 0

PayPal Stock Price Prediction: Earnings Could Spark A 20% Jump

Image Source: Pexels PayPal’s share price is stuck at the 200-day moving average. It has also formed an inverse head and shoulders pattern. The company’s revenues are expected to come in at $7 billion. PayPal (Nasdaq: PYPL) stock price is at a crossroads ahead of the upcoming financial results. It has risen slightly by about 4.3% this year and dropped by over 10.7% in the past 12 months. Worse, the stock has crashed by over 41% in the past five years.In contrast, the S&P 500 index has risen by over 72% in the past five years while the Nasdaq 100 is up by 122% in the same period. Long-term investors have lost a fortune since 2021. $...On April 26, 2024 / By Kurt Osterberg -

Finance 0

Daily Market Outlook – Friday, April 26

Image Source: Unsplash Asian equities saw gains today following strong US tech earnings, rebounding from yesterday’s sell-off in both US equities and bonds triggered by Q1 GDP data showing slower growth and stronger inflation than anticipated. Overnight, the Bank of Japan kept short-term interest rates unchanged, as expected, maintaining them in the 0%-0.1% range after shifting them out of negative territory last month.UK GfK consumer confidence for April was released earlier, with the headline index rising to -19 from -21, slightly surpassing forecasts. This uptrend over the past year suggests modest improvements in consumer fundame...On April 26, 2024 / By Kurt Osterberg -

Finance 0

EUR/USD Forecast: Euro Continues To Grind A Bit Higher

The euro rallied a bit during the trading session on Thursday, breaking above the 1.37 level. The 1.07 level is an area that previously had been support, so it is a little bit of a surprising move, but it doesn’t necessarily change much because we have a lot of work to do regardless. Keep in mind that a lot of what’s going on is a questioning of central bank policy. In the United States, the Federal Reserve is likely to cut rates sooner or later, but later might be the key word. And it could even be next year. In Europe, we have the ECB that is very likely to start cutting sometime this summer, which is essentially what the late...On April 26, 2024 / By Kurt Osterberg -

Finance 0

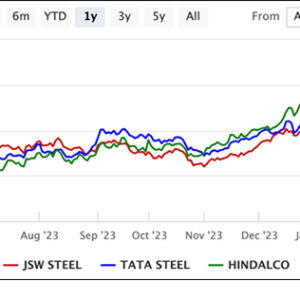

Sensex Today Trades Flat; Nifty At 22,600

Asian shares rose cautiously on Friday as markets sobered up to the idea that U.S. rate cuts were most likely some time away.MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.3%.US equities ended a three-day winning run on Thursday, according to a Reuters, as the tech industry was battered by disappointing projections from Meta, the owner of Facebook and Instagram.Here’s a table showing how US stocks performed on Thursday: Stock/Index LTP Change ($) Change (%) Day High Day Low 52-Week High 52-Week Low Alphabet 157.95 -3.15 -1.96% 158.28 152.77 161.7 103.27 Apple 169.89 0.87 0.51% 170.61 168.15 199.62 162.8 Meta 4...On April 26, 2024 / By Kurt Osterberg -

Finance 0

Rates Spark: Bonds Braced For Another Inflation Pop

Image source: PixabayA higher-than-expected US inflation print yesterday is likely to be followed by another one today. The FOMC meets next week, and had they not been intimating a cut, a hike could have been a discussion point. No change expected though. Markets remain convinced about a June ECB cut, but are now having slightly less conviction about a total of three cuts for 2024. The US 10yr at 4.7% does not look mispriced The US 10-year has just touched 4.7%, and there is no sense that it looks mispriced. The 10-year term premium is still close to zero. Back in October, it was 40bp. Add that back on and we have a 5% handle in a flash. The...On April 26, 2024 / By Kurt Osterberg -

Finance 0

Elliott Wave Technical Analysis: Euro/U.S.Dollar Forex

Image Source: PixabayEURUSD Elliott Wave Analysis Trading Lounge Day ChartEuro/U.S.Dollar(EURUSD)?Day Chart EURUSD Elliott Wave Technical Analysis FUNCTION: Trend MODE: Impulsive STRUCTURE: Red wave 3 POSITION: Blue Wave 3 DIRECTION NEXT HIGHER DEGREES: Red wave 4 DETAILS: Red wave 2 looking completed at 1.08854. Now red wave 3 of 3 is in play. Wave Cancel invalid level: 1.08854 The EUR/USD Elliott Wave A...On April 26, 2024 / By Kurt Osterberg

- 1

- 2

- 3

- …

- 4085

- Next Page »

Top Posts

-

The Importance for Individuals to Use Sustainable Chemicals

The Importance for Individuals to Use Sustainable Chemicals

-

Small Businesses: Finding the Right Candidate for the Job

Small Businesses: Finding the Right Candidate for the Job

-

How to Write the Perfect Thank You Letter After Your Job Interview

How to Write the Perfect Thank You Letter After Your Job Interview

-

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

3 Best Large-Cap Blend Mutual Funds For Enticing Returns

-

China suspected in massive breach of federal personnel data

China suspected in massive breach of federal personnel data