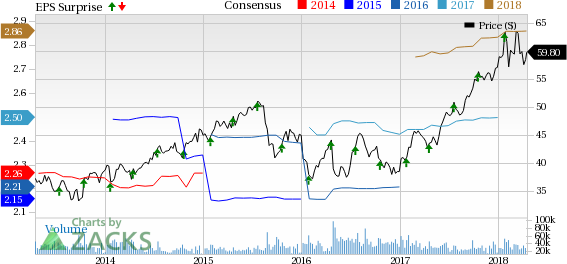

Abbott (ABT – Free Report) reported first-quarter 2018 adjusted earnings from continuing operations of 59 cents per share, beating the Zacks Consensus Estimate by a penny. The bottom line also improved 22.9% year over year and met the high end of the company’s guided range of 57-59 cents. Moreover, reported earnings in the quarter came in at 23 cents per share compared with the year-ago figure of 22 cents.

First-quarter worldwide sales came in at $7.39 billion, up 16.6% year over year on a reported basis. The top line also exceeded the Zacks Consensus Estimate of $7.26 billion by 1.8%.

On an organic basis, (adjusting for the impact of foreign exchange and certain divestments) sales increased 6.9% year over year in the reported quarter.

Quarter in Detail

Abbott operates through four segments, namely Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition, and Diagnostics.

EPD sales rose 9.9% on a reported basis (up 6.8% on an organic basis) to $1.04 billion. This included a positive impact of 3.1% from currency fluctuations. Sales in the key emerging markets increased 8.7% (up 6.8%), driven by double-digit growth in India, China, and Brazil.

The Medical Devices business sales increased 14.6% on a reported basis to $2.74 billion. On an organic basis, sales grew 9.4%.

Cardiovascular and Neuromodulation sales reportedly (up 6.2% on an organic basis) rose 10.5% on double-digit growth in Electrophysiology and Neuromodulation.

Vascular product sales, however, declined 6% on a reported basis (up 1.6%). Within Rhythm Management, the company saw a sales increase of 4.7% on a reported basis (a decline of 1.2%).

Abbott Laboratories Price, Consensus and EPS Surprise

Abbott Laboratories Price, Consensus and EPS Surprise | Abbott Laboratories Quote

Diabetes Care sales improved 44.2% (up 32.9%), buoyed by double-digit international sales growth, led by a consistent consumer uptake of FreeStyle Libre, the revolutionary continuous glucose monitoring system of Abbott.

No Comments