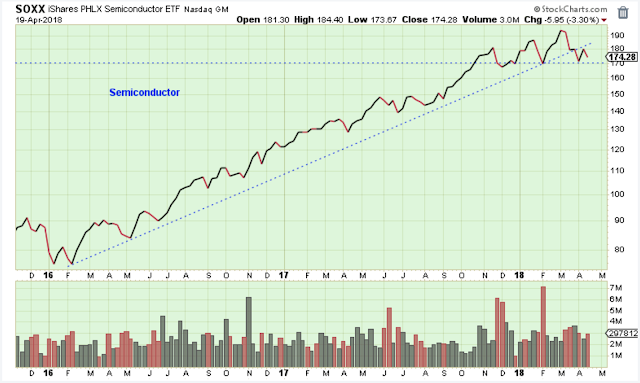

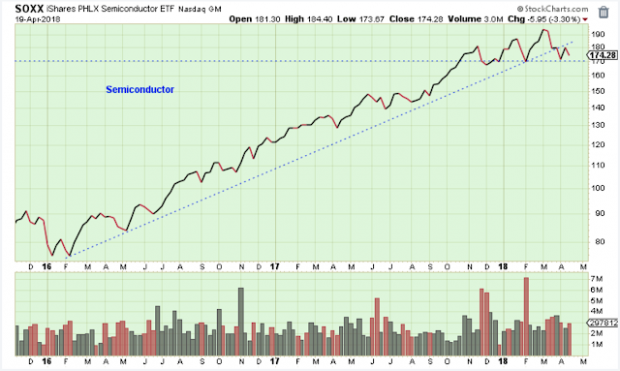

Is this index consolidating sideways, or is this a triple top developing? The group is entitled to a rest after such a strong run, but it is hard to believe that the bull market will survive very long if this index breaks down.

This ETF is one of many inflation-related ETFs that were pushing up to new highs today. Commodities and rising rate funds were today’s winners.

Are we finally seeing a hint of some positive technical action for the precious metals?

I don’t have any special insights into this market. Stocks are volatile and struggling, and at the moment I am more interested in holding onto gains. I am comfortable missing the opportunities to make money by hiding in cash.

How is this for a really great photo I found on Twitter.

Outlook Summary:

The mood swing away from stocks was inevitable after such a terrific run higher for stocks starting with the 2016 election.

I don’t think the bull market is over yet, but it is getting old and we have been very fortunate over the last ten years. Time to start appreciating what we have, and protecting it as best we can.

The long-term outlook is increasingly cautious. Reduce overall exposure to stocks on rallies.

The medium-term trend is down.

The short-term trend is up.

The medium-term trend for bonds is down as of Apr-19. The 10Y yield is back above its 50-day.

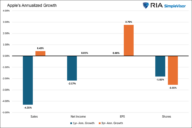

No Comments