Chicago Fed President Charles Evans has been one of the central bank’s doves and so it’s notable that he’s now talking like a hawk, at least on the margins. In a speech on Friday, he said the Fed’s goal of 2% inflation remains on track, which means that “continuing our slow, gradual increases will be appropriate to get us to the point where monetary policy isn’t really providing more lift to the economy.”

He affirmed that “I am optimistic that we are going get to 2%; it would be surprising if we didn’t, I just want to make sure we do.” On that basis, “a gradual increase in our interest-rate range objectives is appropriate.”

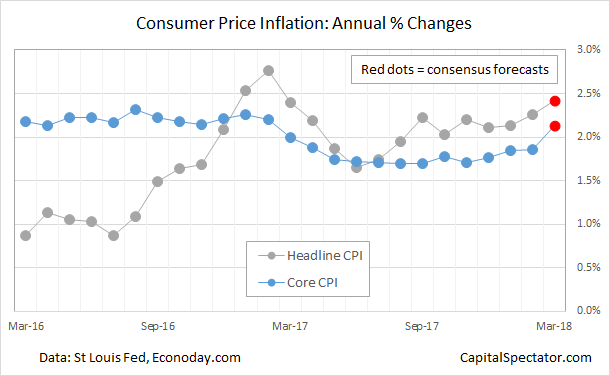

Tomorrow’s March report on consumer inflation is expected to support Evan’s outlook. Keep your eye on the core reading (excluding food and energy) of the consumer price index (CPI), which is expected to rise above annual 2.0% mark for the first time in 13 months, based on Econoday.com’s consensus forecast. Headline CPI is already running above 2% and is projected to tick up to 2.4% for the year-over-year change through March – the highest since Feb. 2017.

Inflation is still tame by historical comparisons, but Wednesday’s update looks set to reaffirm the view that a modest upside bias is in play for the pricing trend. That’s also the message in the New York Fed’s Underlying Inflation Gauge (UIG),which has been posting mildly firmer readings in recent months.

The Federal Reserve chairman is on board with a modestly hawkish bias for setting policy. Speaking at a meeting of the Economic Club of Chicago on Friday, he advised that “the labor market has been strong, and my colleagues and I on the Federal Open Market Committee expect it to remain strong.”

The central bank is expected to leave interest rates unchanged at next month’s policy meeting, according to Fed funds future, but another round of tightening is anticipated in June. Futures in early trading this morning (Apr. 10) are pricing in an 84% probability of a 25-basis-point rate hike to a 1.75%-to-2.0% range in two months, based on CME data.

No Comments