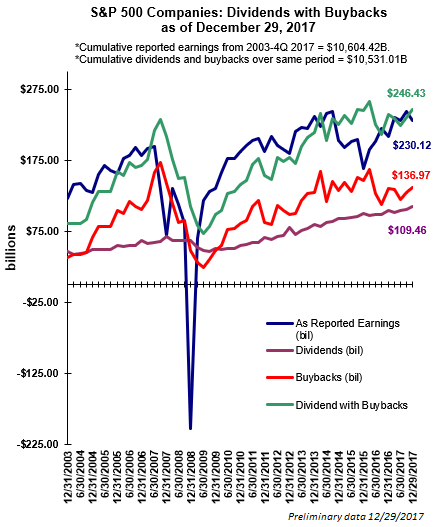

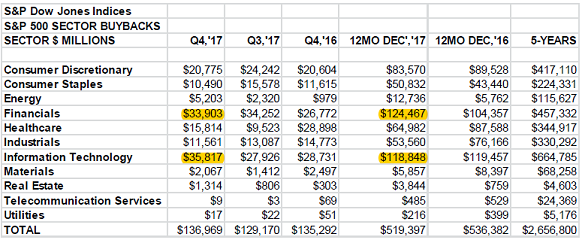

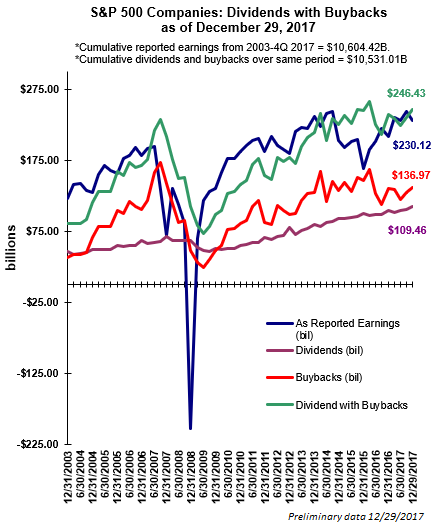

Near the end of last month S&P Dow Jones Indices reported preliminary dividend and buyback activity for the S&P 500 Index for the fourth quarter of last year. For the quarter the dollar amount of dividends paid increased 5.4% versus the same quarter in the prior year. Additionally, for the quarter, dividends combined with buybacks increased 3.1% year over year. It is not uncommon for the combined dividends with buybacks to exceed as reported earnings in the quarter and that was the case for Q4 2017 as seen in the below chart.

Source: S&P Dow Jones Indices

Some highlights from the quarter:

As noted earlier, S&P’s press release mentions the benefits of lower corporate taxes and repatriation may serve as a tailwind for 2018.

No Comments