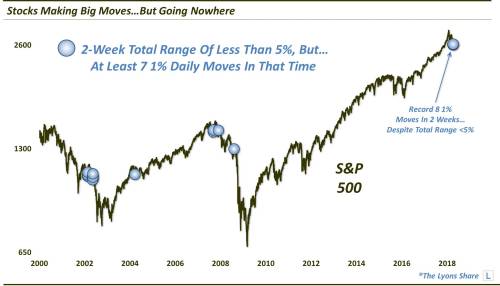

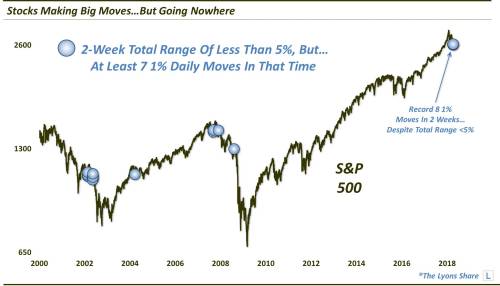

Over the 10 trading days (2 weeks) through April 6, the S&P 500 averaged a daily range of 2.3%. According to Dana Lyons of the Lyons Share, that kind of volatility ranks in the 94th percentile since the S&P 500 began in 1950.

Similarly, it is uncommon to see at least seven 1%-plus price swings in a brief period like two weeks. We actually had eight. More remarkably, it is rare to witness this type of price movement when it is confined to a total range of 5% or less. How unusual? Less than 1/10 of one percent of trading sessions in the S&P 500’s history.

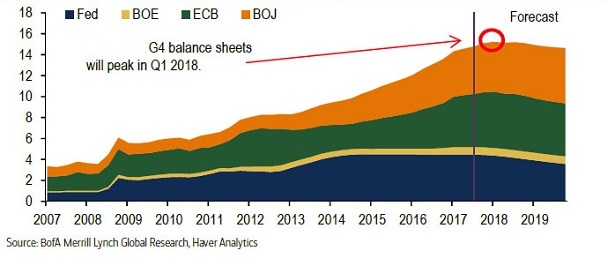

In the chart above, it appears that the occasions (14 in total) may have acted as a warning sign. For example, in 2001, big price swings accompanied by range-bound markets (< 5%) preceded the painful bearish depreciation of 2002. More ominous? The same thing happened leading into 2008’s financial crisis. In 2004, however, it was “much ado about nothing.” Here in 2018, the volatility alongside range-bound stocks may indeed be relevant. Why? Volatility is inversely related to financial system liquidity. It follows that as long as the Federal Reserve (and other prominent central banks) remain committed to removing liquidity by reducing bloated balance sheets, one can expect the volatility to increase.

In the same vein, committee members at the Federal Reserve appear determined to hike shorter-term interest rates. Yet longer-term rates have not responded as much as central bank planners would like. Consequently, we are looking at the flattest yield curve since 2007.

On the surface, there may not be a problem with 10-year Treasury bond yields mimicking 2-year Treasury bond yields. Or 30-year Treasury bond yields resembling 5-year Treasury bond yields.

On the other hand, neither the U.S. stock market nor the U.S. economy has ever performed particularly well when longer-term yields fall below shorter-term ones. The phenomena is called “yield curve inversion,” and it is often associated with economic recession. Indeed, should the Fed remain resolute, the 40 basis point differential between the 30-year and the 5-year might evaporate quickly and subsequently invert.

No Comments