Technology advances have infiltrated every corner of finance, including the world of wealth management. While few can argue with the positives of automated, algorithm-based portfolio management platforms, the advent of the cost-efficient, dispassionate robo-adviser has struck fear into the heart of many a financial adviser and fund manager, who see these technology options as a threat to their business practice.

Full-service wealth management has survived the birth of discount brokerages and the online trading boom. It will survive the latest influx of robots, whose advantages will eventually mimic each other to the point of being indistinguishable. One thing about robot advisory platforms is that they’re entirely passive from the end user’s point of view. They ride the market. They don’t outperform. They aren’t emotional. However, they don’t call the client. They can’t respond to specific questions. They can’t form any sort of relationship with a client and be a resource to them for a range of life-planning needs beyond investment performance. They will never replace full service wealth management, though they can be a resource within this business.

What are the benefits of robo

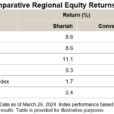

Lower fees. Most of these robo advisers charge less than 1%, with some south of .20%, versus the standard investment adviser fee range of 1-3% on a client’s portfolio. This difference alone can make for a slight outperformance over traditional investment services for many individuals.

Lower cost of entry. In addition to being economical from a management fee perspective, oftentimes the robo platform will allow for client portfolios to be as small as several thousands of dollars, versus a tenfold or higher threshold for traditional portfolio management accounts.

Elimination of emotional trading. With a robo adviser executing a passively managed program, there is no chance of active management decision-making being affected by human emotional reaction to markets.

No Comments