“If you can’t measure it, you probably can’’t manage it.” – Ed Seykota

Below is a brief recap of last week’s price projections and the price targets for next week.

The SPX broke above resistance, came within 3 points of our target and reversed. In the process it broke below the CIT Cloud, breakout and support lines. As long as it remains within the channel and above the monthly pivot line at 2635, the current down move qualifies as a counter-trend swing and the intermediate trend remains up.

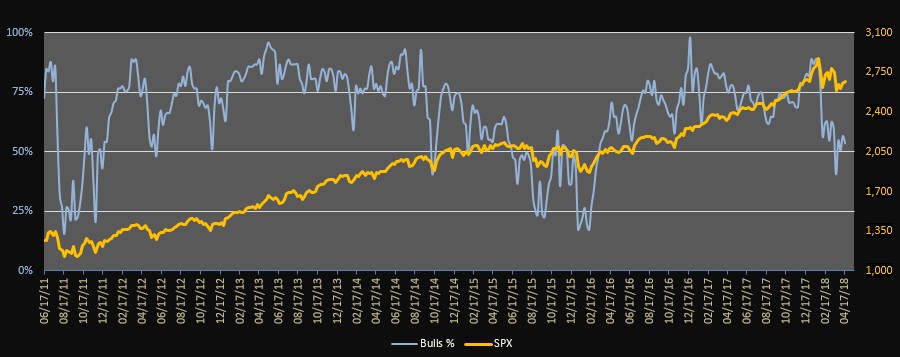

Weekly bullish sentiment continues to hover around 50%:

The projected price range for next week for the E-Mini is 2615 – 2755:

The trend of the Euro remains flat and the analysis remains the same as last week.

The projected price range for next week for EURUSD is 1.220 – 1.245:

The Pound hit both the upside and downside projections retracing the whole April upswing. A break below the monthly pivot line at 1.40 will turn the trend negative.

The CIT Channels projected trading range for next week for GBPUSD is 1.387 – 1.4225:

The upward bias of USDJPY continues.

The projected trading range for next week for USDJPY is 106.3 – 108.4:

The expected USDCAD reversal came on Tuesday within a few pips of our projected support level, and closed the week just above our upside target. The CIT Oscillator is getting overbought, suggesting that the USD is closing in on its upside target against the CAD.

The projected trading range for next week for USDCAD is 1.256 – 1.285:

The uptrend of the USD against the CHF accelerated after it broke above the 0.964 resistance level, and it closed the week just above our upside target. By doing this, the USD is quickly closing in on an area of heavy resistance between 0.98 and 1.00.

Projected range for next week for USDCHF is 0.9625 – 0.9825:

The Aussie met resistance at our upside target, and reversed sharply lower to close the week a few pips below our downside target. The channels point in different directions (yellow light next to dates), signaling that the trend is mixed, thus favoring short-term swing trades.

No Comments