Previous:

On Monday the 16th of April, trading on the euro closed up. The euro started rallying as trading got underway in Europe. The main reason for this was the universal decline of the US dollar, brought about by America’s military action in Syria.

Despite this, markets opened relatively peacefully. One thing I don’t understand is why Asian market participants didn’t start buying gold, CHF, or JPY after the airstrike occurred. Later, as the Europeans entered the market, they started shorting the dollar. Retail sales data from the US wasn’t enough to provide support to the greenback.

With Syria dealt with, President Trump once again took to Twitter to accuse Russia and China of playing a “currency devaluation game”. He could have saved himself the trouble; everyone knows that Russia and China is to blame for everything in the world. After rising to 1.2394, the euro stabilised against the dollar around 1.2380.

Day’s news (GMT+3):

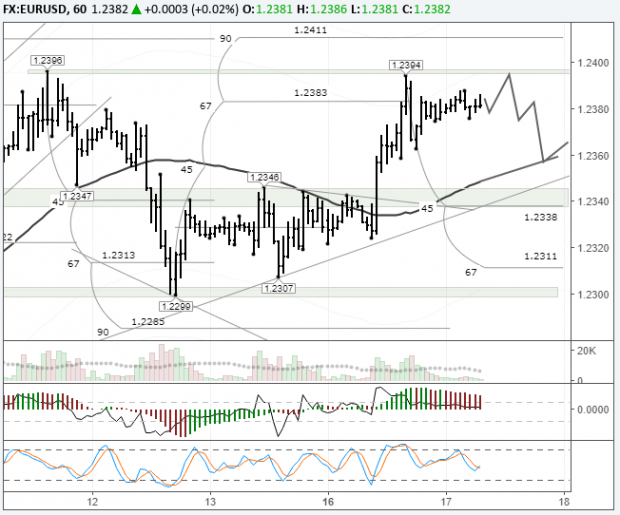

Fig 1. EURUSD hourly chart. Source: TradingView

Yesterday’s predictions came off perfectly. Trading in Europe pushed the euro up towards 1.24. At the time of writing, the euro is trading at 1.2388 against the dollar.

What can we expect from markets today?

There are plenty of important events in today’s economic calendar. In Asia, the dollar is trading down against the yen, pound, and euro, while trading up against the rest of the majors.

All of the euro crosses have made gains except for EURJPY. This means that our main pair could renew yesterday’s high of 1.2394 as trading in Europe opens. The hourly cycles suggest that the euro is set to decline for the rest of the day. The LB balance line will be at 1.2358 throughout the day. It’s to this level that I expect trading on our pair to drop today.

No Comments