It is clear that gold is preparing a mega-breakout. After a 7-year bear market, I started sensing a couple of months ago that Gold would break out, starting a bull market in 2018. More recently, we confirmed our viewpoint with this article: Gold And Silver Bull Market Of 2018 About To Start.

Today, we see another strong day in gold, which is moving above the so important $1360 price level.

As all this is taking place in the gold market we see another signal confirming strength is returning in gold: ‘risk on’ is returning on rising gold prices. That, of course, is a strong ‘market internal’ indicator.

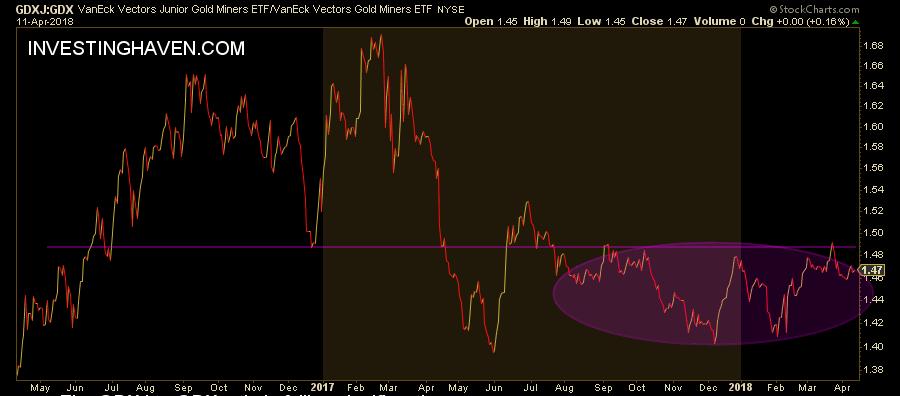

We are specifically focused on the junior gold miners to gold mining index. Technically, it is the GDXJ to GDX index ratio. The chart below shows the evolution of this ratio.

Visibly, in 2017 it was weak, very weak, and it contributed, as a secondary indicator, to conclude in October that the price of gold would not be bullish in 2018. Since December, though, we start seeing strength, and it continues to build momentum.

It is one of the many signs we got that confirms our thesis: gold will be bullish in 2018! Junior gold miners will do well in this environment, though it can well be that the gold price will be the strongest in this early phase of the new gold bull market.

No Comments