Honeywell International Inc. HON posted impressive first-quarter 2018 results with a year-over-year surge in revenues and adjusted earnings.The company’s adjusted earnings of $1.95 a share surpassed the Zacks Consensus Estimate of $1.89 by 3.2%. Notably, the reported figure increased 17.5% on a year-over-year basis.

Operational Details

Honeywell’s first-quarter revenues came in at $10,392 million, up 9.5% year over year. The top line also exceeded the Zacks Consensus Estimate of $9,936 million. This impressive performance can primarily be attributed to higher revenues accrued from each of the four segments of the company.

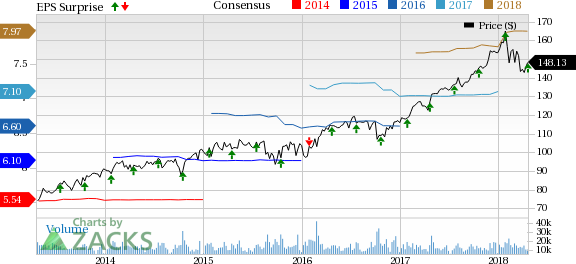

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. Price, Consensus and EPS Surprise | Honeywell International Inc. Quote

Total segment profit was $1,995 million compared with $1,789 million in the prior-year period. Overall segment profit margin improved to 19.2% from 18.8% in the year ago.

Also, operating income increased to $1,801 million from $1,534 million in the year-ago quarter. Operating income margin in the first quarter was 16.6%, up 40 basis points (bps) year over year.

Operating Costs

In the reported quarter, the company’s total cost of goods sold totaled $7,193 million compared with $6,529 million in the prior-year period. Selling, general and administrative expenses came in at $1,475 million, up 3.7% year over year. Interest expenses and other financial charges were $83 million compared with $75 million in the year ago.

Segment in Details

Aerospace sales were $3,977 million in the reported quarter, up 12.2% year over year. This impressive performance can be attributable to commercial OE and U.S. defense growth. Moreover, strength in the light vehicle gas and commercial vehicle turbochargers in Transportation Systems proved conductive to the segment’s growth.

Home and Building Technologies revenues came in at $2,433 million, up 7.2% year over year. The upside was driven by solid demand for residential thermal solutions and thermostats. Also, continued strength in ADI globally as well as strong backlog conversion in the energy vertical within Building Solutions supported the segment’s growth.

No Comments