Per the latest report from the Institute of Supply Management, manufacturing activity in the United States dipped slightly in March compared with February. However, this apparent decline is rather a correction and momentary. Further, it is also indicative of a burgeoning economy even as the global markets remain resilient.

Such claims can also be supported by the fact that manufacturers are on a hiring spree. Such jobs not only offer relatively higher wages but also create multiplier effects within the economy, unlike other service sector jobs. Hence, a booming manufacturing sector is likely to boost the economy as a whole. Finally, a weakening dollar has made the U.S. manufacturing sector competitive by boosting global demand for indigenous produced goods.

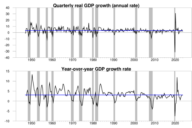

Correction Not a Decline

The ISM manufacturing index for the month of March came in at 59.3% compared with 60.8% in February — when the index hit a 14-year high. However, it would be wise to call such a dip as correction rather than a decline.

What should be noted is that any reading above 50 is indicative of an economic expansion. In fact, 17 out of the total 18 manufacturing industries that were surveyed, reported growth in March. This clearly indicates that the U.S. heavy industrial sector is advancing steadily.

Further, the report stated that the reading for new orders, production and employment all declined in the period. It is however, important to note that all these metrics are hovering near all-time highs hit recently.

Also, spending on capital goods ticked up in February supported by solid business confidence, strength in global economic growth and weakness in greenback. Moreover, the Backlog of Orders Index expanded for the 14th straight month to log its highest reading since May 2004.

The recent weakness in manufacturing activity has risen due to seasonal fluctuations such as labor and skill paucity which has weighed on production in the economy. Further, inputs have been affected mainly by factors like harsh weather conditions, Asian holidays, transportation difficulties and disruptions in the steel and aluminum industries primarily due to trade war fears. It is therefore safe to say that manufacturing will spring back to normal action in the next few days.

No Comments