Thoughts

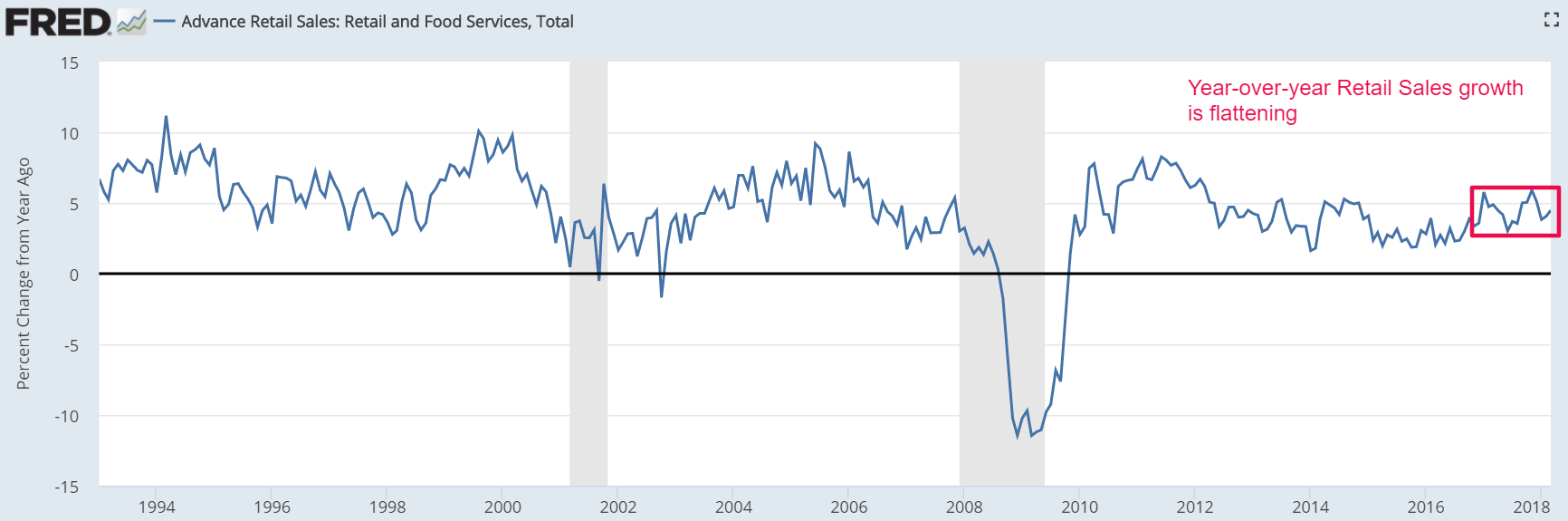

1 am: Retail Sales growth: this bull market in stocks still has 1-2 years left.

Retail Sales increased 0.6% month-over-month (up 4.5% year-over-year). More importantly, the year-over-year growth in Retail Sales is flattening.

This is typical of the final 1-2 years of an equities bull market and economic expansion. There are no signs of sustained economic deterioration right now, but the economy’s growth rate cannot really pick up. Growth is flattening. Retail Sales is a medium-long term bullish sign for the stock market right now. We are watching out for sustained deterioration in the economic data.

*The stock market and economy move in sync over the medium-long term.

1 am: U.S. could increase trade tensions with China. A short term bearish factor for the stock market.

China places a lot of restrictions on U.S. internet companies. For example, companies like Google and Facebook are banned from China altogether. Other companies like Microsoft and Amazon have to operate jointly with Chinese partners – they’re not allowed to operate independently in China.

The Office of the Trade Representative is currently considering placing a COMPLAINT against China’s unfair policies towards foreign tech companies.

If this COMPLAINT is actually announced, I expect it to be a short term bearish factor for the stock market. The market will probably fall for 1-2 days. But it is not a medium-long term bearish factor for the stock market. A complaint is not the same thing as an action. U.S. companies have long complained about China’s unfair policies towards foreign tech companies.

No Comments