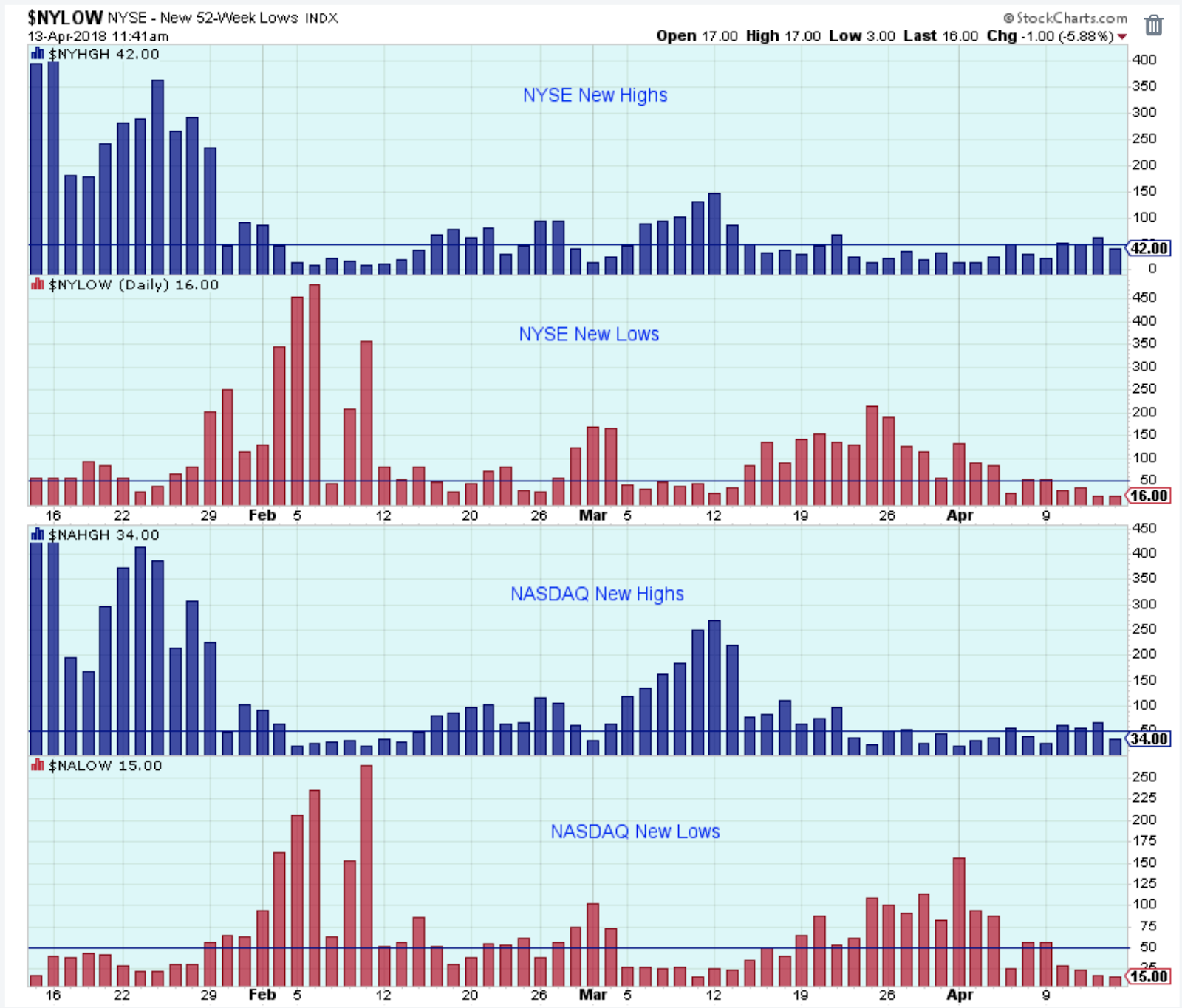

The market wants to rally short-term, but it just can’t find the buyers. An uptrend has to have a number of new 52-week highs, and there are very few at the moment.

Side Notes:

VIX Squared has reported on Twitter that bullish sentiment is now down to a level that favors stock prices from a contrarian point-of-view.

Investors.com pointed readers to a CBO report that estimates the Federal deficit to be at least 2 Trillion dollars by 2028. Insanity!

Outlook Summary:

Investing Themes:

Strategy:

Buy large cap stocks and ETFs on pullbacks of the medium-term trend.

Buy small cap growth stocks on break outs to new highs during short-term up trends.

Stop buying when the short-term trend is at the top of the range.

Take partial profits when the uptrend starts to struggle at the highs.

Never invest based on personal politics.

No Comments