Yesterday, for the umpteenth time in the last few years, we exposed the clear manipulation of VIX at the futures settlement auction – spiking VIX to favor the record long positioning of VIX futures speculators.

With stocks quietly drifting sideways ahead of the US cash open this morning, VIX suddenly spiked reprising a pattern of jerky moves on days when futures on the gauge are settled in monthly auctions…

As a reminder, VIX futures settle on Wednesdays at 9:20 a.m. New York time in an auction by Cboe Global Markets.

As Bloomberg notes, VIX was heading for its longest streak of daily losses in almost a year in early New York trading, before it reversed direction and rose as much as 11 percent.

The gain occurred around the time of the settlement, which happened 13 percent above the VIX close on Tuesday and outside of today’s range.

Both the settlement price and the high-water mark for the VIX occurred more than 10 percent above Tuesday’s close — lucky if you were betting on a gain.

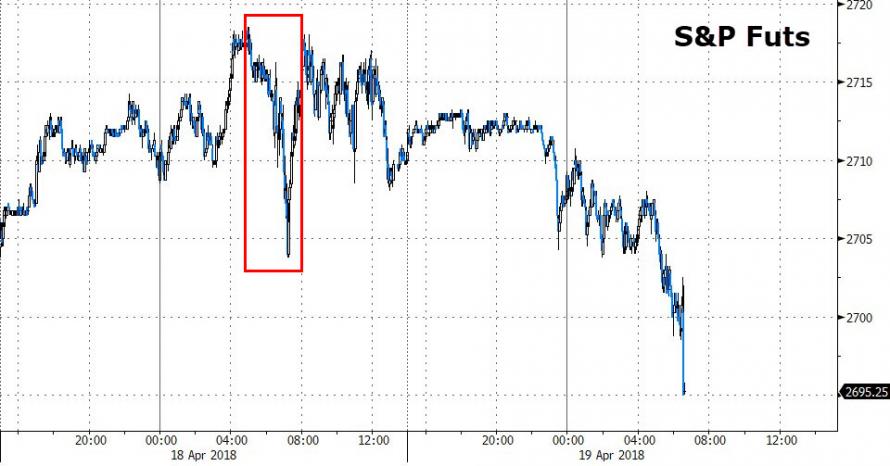

And as VIX was manipulated around the auction, so the option-market ‘tail’ wagged the broad-stock-market ‘dog’ – slamming the S&P down almost 20 points.

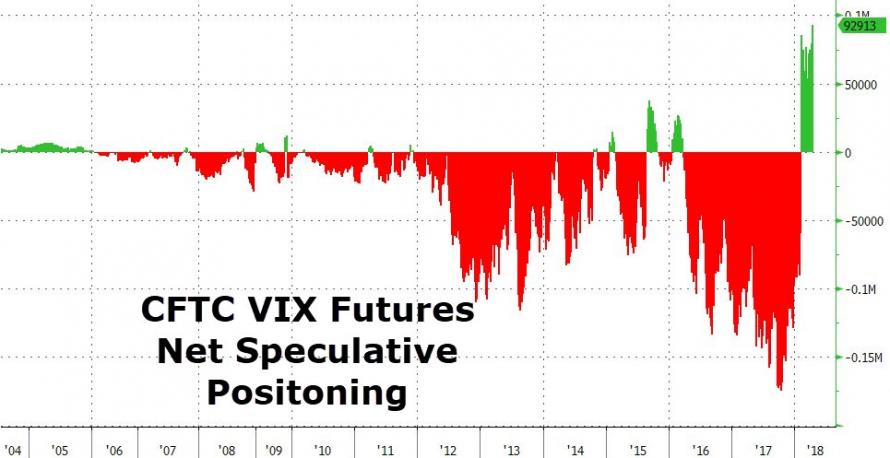

And don’t forget, large speculators hold a record net-long VIX futures positions, according to the latest data from CFTC…

So this settlement spike was very much in favor of all those speculators – after a week of crushing them – how convenient.

So just how easy is it to do this?

How do ‘traders’ manipulate the options market, thus moving VIX in their favor, to rig stock momentum one way or another?

Bloomberg reports that Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors, says the VIX – a gauge of the implied volatility of the S&P 500 Index derived from out-of-the-money options – was ‘gunned‘.

That is, it was intentionally pushed higher.

A massive bid for protection against a tumble in equities caused the prices of put options to soarin early trading on Wednesday, effectively forcing up the official settlement level for VIX.

“Around 9:15, suddenly a bid emerged for the extremely far downside options, pushing the early indication [of the VIX] up 1 point,” Chintawongvanich said.

“By 9:30, the early indication was around 17.50, up over 2 points from the 9:00 a.m. level, despite S&P futures remaining unchanged.”

No Comments