Look, the ECB came across as pretty upbeat on things in their annual report. I talked a bit about that earlier this week.

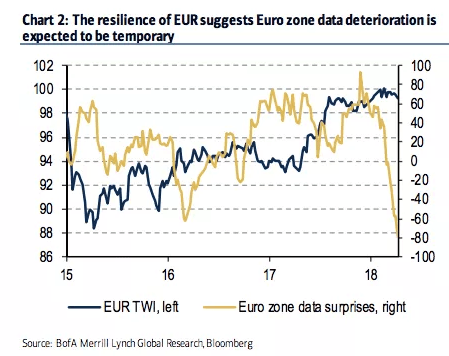

I also showed you the following chart from BofAML which seems to suggest that Draghi may have missed his window or if he hasn’t missed it yet, may be well on the way to missing it:

“Markets are assuming Euro zone data deterioration will be transitory,” BofAML wrote in the piece that chart is from, adding that “the immediate focus in terms of weaker data is the Euro zone, where data surprises are now the most negative since the peripheral crisis.”

To be sure, the ECB is playing that down. “In the first few months of this year we have seen a softening of a number of indicators, but they’re still fully in line with the good scenario that we have, so we don’t see reasons to change our assessment of our projections,” chief economist Peter Praet said in Frankfurt this week, following the release of the annual report. “We have to be careful because downside risks have increased, but in a context where risks remain broadly balanced.”

Ok, so that brings us to the March ECB minutes, out Thursday morning. These are from the meeting where the bank removed the dovish language around APP. As a reminder, the sooner APP is wound down completely (reinvestments notwithstanding), the sooner the hikes can commence, so depending on the internal discussion about the language tweak at the March meeting, it might be possible to divine something about the likely timing of the first hike.

Well in the minutes, we discover that while “all members agreed” to remove the easing bias from the statement, they also agreed that that move “should not be misunderstood as restricting the Governing Council’s capacity to react to shocks and contingencies if necessary.”

They’re also cautious on all the usual shit. Specifically, they’re concerned about the extent to which the FX market is reacting more to expectations for policy than it is to changes in the economic outlook and they’re worried about protectionism (don’t forget that Draghi had to chin check a certain Treasury Secretary back in January whose weak dollar Davos rhetoric threw a monkey wrench in the ECB’s efforts to normalize without triggering an outsized FX reaction). To wit:

No Comments